Business Insurance

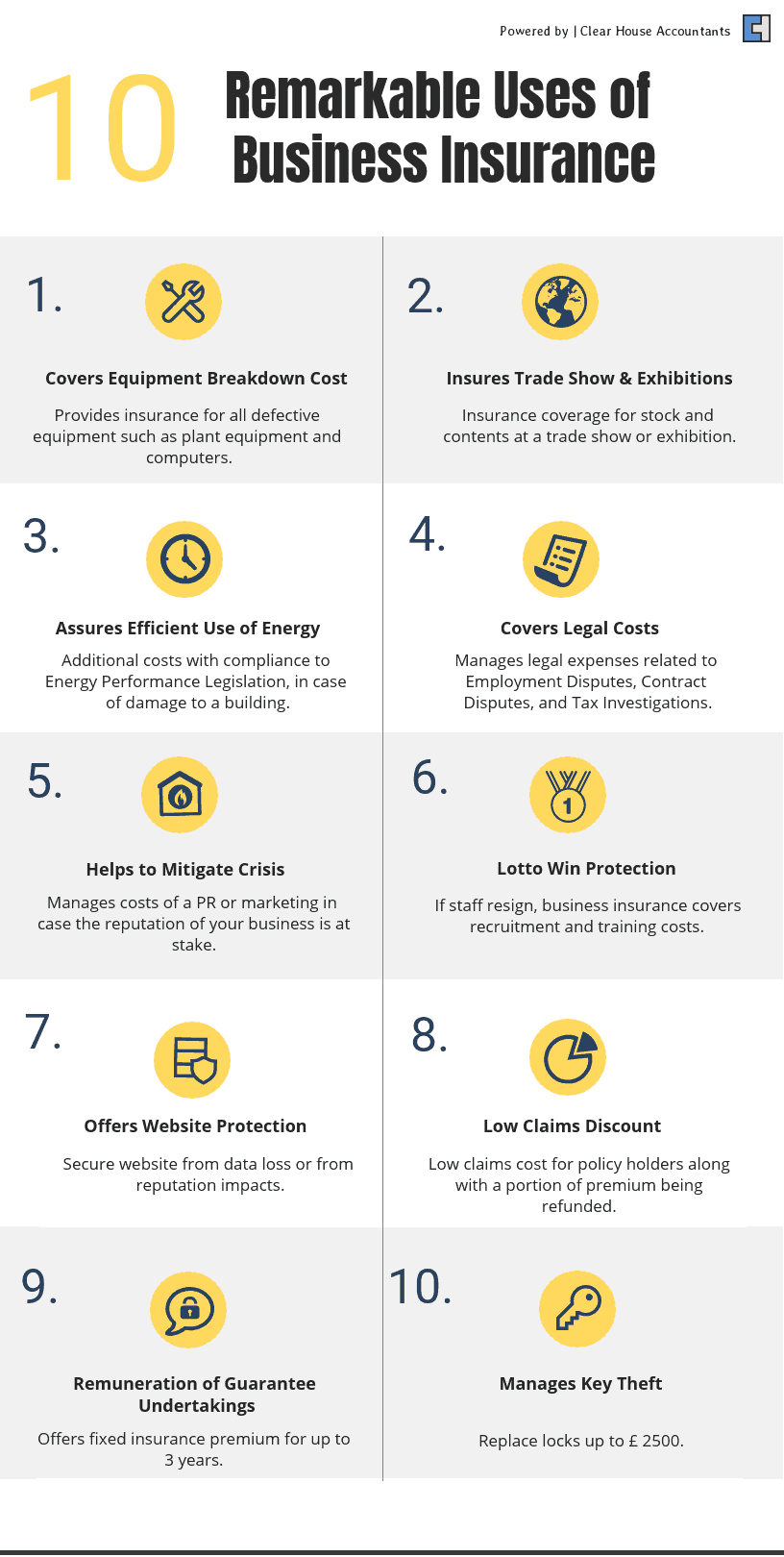

The insurance industry in the UK is highly regulated through prudential regulation as supervised by the Bank of England. Insurance is a contract that acts as a reliable safeguard against any potential financial losses. A business insurance plan provides financial protection to a company. It is a type of risk management strategy that is used to mitigate the risk of an uncertain loss that the business might come across, according to research carried out by a major insurance broker, Gallagher. It was confirmed that SMEs paid out £ 6,416.50 on average to deal with crisis incidents.

As a business owner, the first step that you need to perform is to figure out the level of risk associated with the type of business you are engaged in. Depending on the nature of your business, it is highly likely that one way or another, you will need insurance to mitigate risks and prevent substantial financial losses.

Businesses are unique in various aspects and, therefore, face different types of risks. However, for the sake of financial safety and stability, business owners should enrol their companies under at least key insurance schemes required for the protection of their business.

An insurance policy will cover certain aspects, such as the risks of incidents and accidents if you believe that due to certain events, the business or its client will suffer financially or physically. You might want to purchase the coverage needed. This would help to mitigate the risks that could result in a loss to the business, clients, and employees.

Our accountants have prepared a list of the different types of business insurances that you should know about; these are just a few of many, it is recommended to speak to an insurance broker who can guide you in more detail.

Video: How to Choose an Insurance Broker

Insurance brokers are experts in matters of insurance and provide risk management to those in need. Find out ways through which you can find an insurance broker and how you may register a claim.

Employer’s liability insurance

Businesses require competitive employees in order to grow and progress. However, hiring new employees comes with a number of responsibilities, such as registering for an employer’s liability insurance, even if the hiring is for a short period. This type of insurance covers compensation claims that can be made by employees due to either a medical injury, illness or financial damage caused while working at a company. The medical liabilities are placed on the company only when the issue occurs due to the nature of the company’s work. We have created a guide that can help you recruit employees effectively for your business.

Under certain conditions, some companies are not liable to enrol under an Employer’s liability insurance. Especially if they only hire close family members.

Public liability insurance

Public liability insurance (PLI) is mandatory for your business if you provide a service that requires your business to come in contact with the public frequently. For instance, if you run a restaurant or a hair salon. Then, public liability insurance will be compulsory for your business. This type of insurance can help protect you from claims regarding damages caused to your customers, suppliers or any third party involved.

Public liability insurance does not cover all kinds of costs, though. The following costs are included in the public liability insurance plan.

Injury: It covers the cost of someone being injured on the premises owned by your business.

Damage to property: This coverage provides insurance for you if you cause damage to someone else’s property while your equipment or staff is on their premises.

Legal Expenses: The cost of hiring a lawyer in case a lawsuit has been filed against the business due to the above-mentioned reasons.

Business buildings insurance

This type of coverage will be suitable for your business if you work from home or use other business premises. Other premises, such as a coffee shop or a pub, for daily operations. Suppose the premises you are using are rented out. You should make sure to check what kind of costs the rental fee covers. This will eventually help you calculate your insurance policy pricing. A business building’s insurance will provide coverage for theft and accidental damage such as fire, pipes bursting, etc. It also provides coverage in case of social unrest or business interruption due to unforeseen events.

Stock insurance

Suppose the nature of your business requires you to store or maintain items in stock in the office or warehouse premises. Then, stock insurance can provide you with the necessary coverage. The insurance will cover the costs of replacing the stock in case it is either partially or entirely damaged or, in the worst case, stolen.

Product liability insurance

If, for some reason, you have provided a faulty product that caused harm or injury to a customer who purchased it. In that case, you might be held responsible for the damage and can be charged huge penalties and fines. Product liabilities can be claimed in case your products have caused bodily injury to a customer, property damage or have caused sickness due to the consumption of food or drink. Product liability insurance can provide your business with substantial coverage. This will help to curb the financial losses that result from the claims mentioned above.

Business legal protection insurance

Suppose you want to secure your company from the costs of legal suits against your business. You should look at business legal protection insurance. This type of insurance will provide legal protection with the added benefit of covering commercial legal expenses of a lawsuit.

There are two types of business legal protection insurance for small businesses:

- Before-the-event cover (BTE)

- After-the-event cover (ATE)

Business content insurance

Business content insurance is the type of insurance that can help compensate for the costs of repairing and replacing office equipment and tools in case they have been damaged, destroyed or stolen for some reason.

Professional indemnity insurance

If you provide a service that requires you to provide consultation or advice, this insurance can help you protect your business from professional errors or incorrect advice that you might give to a client. You would need professional indemnity insurance under the following circumstances:

- Your business provides consultation or advice.

- Your business provides designs such as services provided by engineers or architects.

- You wish to protect yourself from any errors or mistakes that you might make.

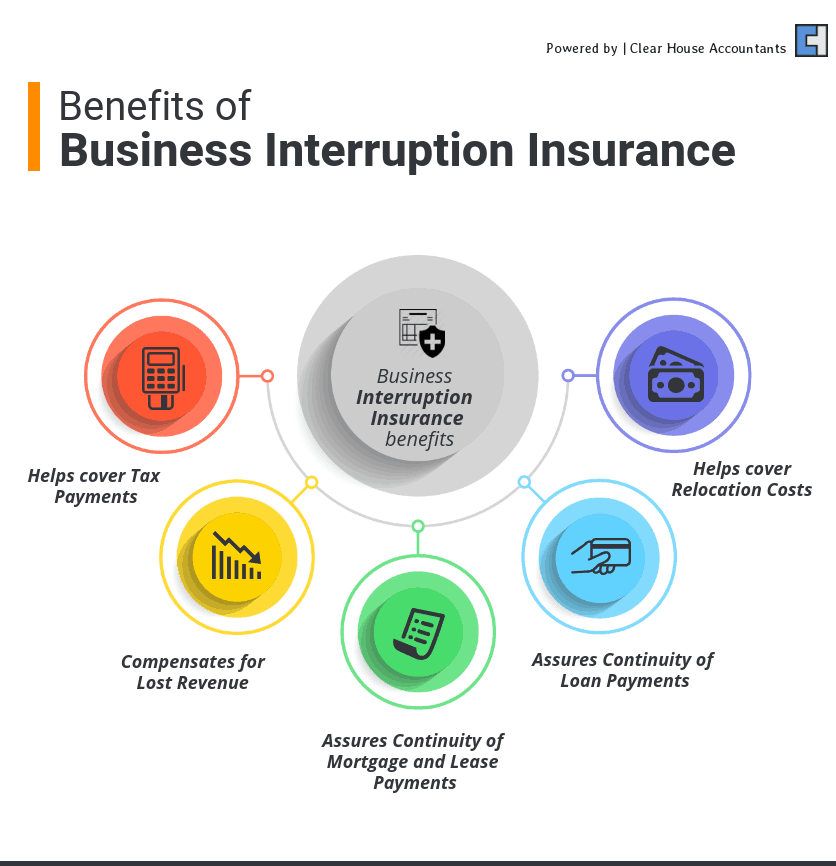

Business interruption insurance

Most business owners usually overlook this type of business insurance. This is because they are mistaken that the other insurances will provide them with the relevant coverage in case of an interruption. Business interruption can be caused due to many reasons. The common ones are in case of a flood or fire. The ongoing situation due to the coronavirus pandemic has proved the importance of business interruption insurance. The crisis has resulted in business interruption on a global scale.

Business interruption insurance covers financial losses that have been incurred as a consequence of a business interruption. These can be loss of profits, loss of income or the cost of bearing staff income.

Learn more about HR and how to manage your employees’ payroll.

What type of insurance is ideal for small businesses?

No matter what the size of your business is. You will need several insurances to protect your business and customers from potential financial losses. However, there isn’t any specific type of insurance a small business needs. Instead, it depends upon the kind of services they are providing and the way they manage their business operations. For instance, if you are a sole trader and plan to work all by yourself for at least a period of one year. In that case, you won’t be required to register for Employer’s liability insurance.

To select the best insurance package for your business. You must figure out what business aspects you want the insurance to cover. You can then select any of the schemes mentioned above and select your policy accordingly.

If you are still unsure about what type of insurance to pursue, then it’s desirable to speak to an accounting firm or accountant to help you implement a risk plan in your strategic business plan and to recommend a good insurance broker.

Clear House Accountants are expert Accountants for businesses in London who provide quality bookkeeping services, financial reporting, data analysis, business consultancy, and other strategic planning services. Our accountants have been successful in extending their financial knowledge and expertise to businesses of all sizes along with ensuring that they save as much time and money for their clients as possible.