Many employees in the UK pay National Insurance Contributions (NIC) before they get their income. Employees pay Class 1 NIC on their gains from employment such as bonuses, salaries, etc. the amount of insurance that employees pay depends on how much they earn in a specific period. There is a primary threshold for paying insurance, and if you fall below this criteria, you are not required to pay NIC. For 2022/23, this threshold is £967 per week or £4,189 per month.

In the year 2022/23 Class 1 NIC weekly rate for employees is as follows:

| Amount | NIC Weekly Rate |

|---|---|

| On amount above £967 | 3.25% |

| On income between £190 and £967 (6 April – 5 July 2022) or On income between £242 and £967 (6 July 2022 – 5 April 2023) | 13.25% |

| On the first £190 | Nil |

In the year 2022/23 Class 1 NIC monthly rate for employees is as follows:

| Amount | NIC Weekly Rate |

|---|---|

| On amount above £4,189 | 3.25% |

| On income between £823 and £4,189 | 13.25% |

| On the first £823 | Nil |

Generally, Class 1 NIC is calculated month by month or week by week, depending on whether your employer pays you monthly or weekly and is not cumulative like income tax deducted under PAYE. It is pretty known for those who work through an umbrella company to think they are paying employer NIC. However, it’s not always the case but instead leads to confusion about how an umbrella company works.

Are National Insurance Contributions Applicable On Pension Income?

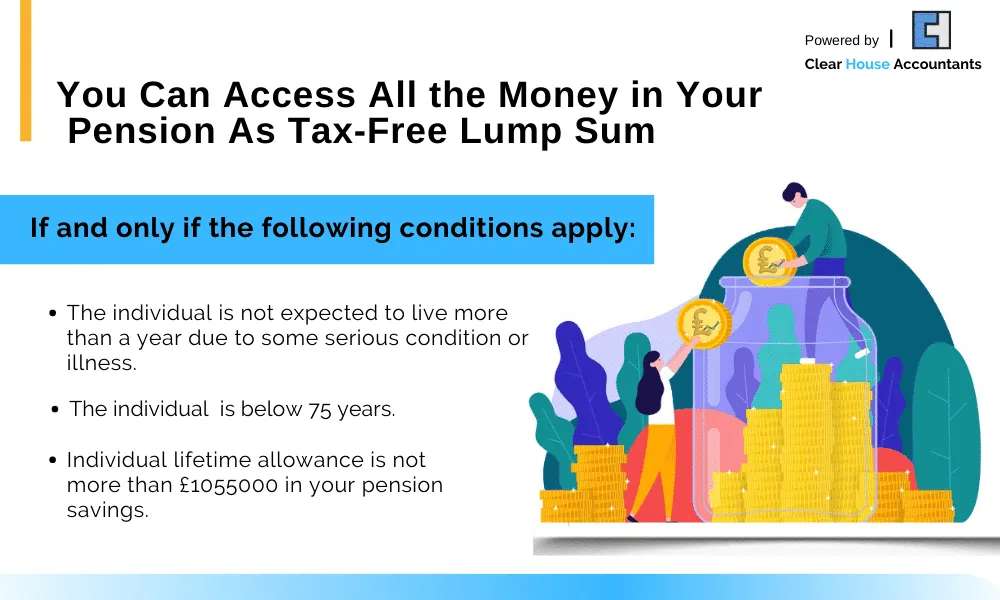

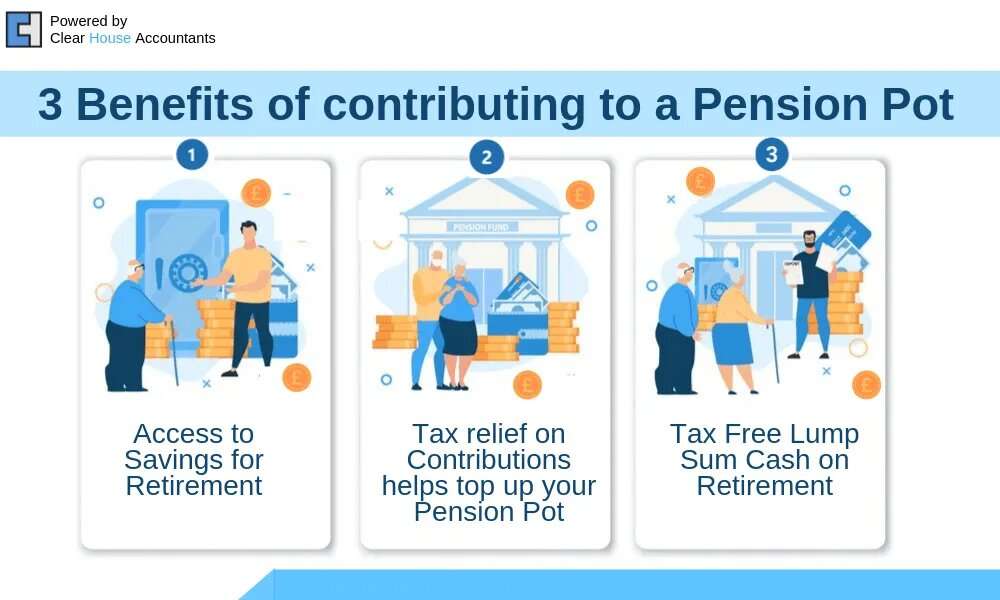

NI is payable from the age of 16 years until retirement age. Once you reach the state pension age, there is no need to pay NI on pension income. However, you may have to pay income tax if taxable income is more than the personal allowance. If you choose to take out any lump sum from pension earnings, there is no obligation to pay NI Contributions. Moreover, the first 25% of this lump sum is free from income tax as well.

If you’ve been employed, you need to pay Class 1 NI contributions as a percentage of income. under self-employment, you will pay Class 2 contributions at a uniform weekly rate and class 4 NIC as a percentage of your income. However, if somebody chooses to work even after the state pension age, in that case, the employer is still responsible for the NI contributions on employees’ earnings even though they no longer have to pay employee contributions.

Some people get early retirement. In this scenario, they can take pension income early. However, you will receive less state pension because you haven’t made enough NI contributions.

Understanding how National Insurance Contributions impact pension income is crucial, whether you’re managing your earnings efficiently, securing future state pension entitlements, or calculating self-employed taxes.

How Can You Claim Back National Insurance?

You can also claim back any overpaid National Insurance from HMRC. Different classes exist for National Insurance, and you will be asked which class you want a refund. The class you pay depends on your employment rank and income.

Employees belonging to Class 1 who earn more than £190 a week come under state pension age, and their NI is automatically deducted by the employer. For Class 1A or 1B, employees pay directly for their benefits or expenses.

Class 2 belongs to self-employed people earning more than £6,725 a year. However, if someone makes less than this amount, they can pay voluntary contributions to fill gaps in their NI record. These voluntary contributions also come under Class 3. In Class 4, self-employed persons come who are earning profits of £9,881 or more.

The government’s official site GOV.UK has provided information and critical steps on how to claim back the refund.

What Are The New State Pension Rules?

After 2016 the new state pension rules were implemented, and according to the new rules from April 2016, the number of years for qualifying state pension has increased to 35 for both men and women. Previously state pension consists of two parts-basic state pensions and additional state pensions. The new pension consists of only a single amount which is greater than the basic state pension. In 2022/23, the level of the new state pension is £185.15, although you get more or less from this. The new pension rate is applied if you reach the pension age on or after 6th April 2016. Otherwise, it does not apply to you. The old rules and regulations will apply if you decide to delay or defer your state pension.

Under new state pension rules, at least ten qualifying years on the National Insurance record must get any kind of state pension. These are the years in which either you have been paying NI or getting NI credits. NI credits are given to you in scenarios when you are too ill to work or unemployed. Self-employed people are better off under the new system because their contributions will count for more in the long run. If you’ve been ‘contracted out’, i.e. you’ve been paying less NI but receiving a higher private pension, you’re most likely to have a starting amount of less than £185; however, you can build up to that level through further contributions if there are enough years left in your employment.

Additional Resources