If you are Self-Employed, be prepared for the 31st July Deadline

What do you need to know about HMRC’s Self Assessment System and why is it so important to know about?

The HMRC’s Self Assessment System is a systematic process adopted by self-employed individuals to pay their taxes in the UK. About 15% of the UK’s working-age population is now self-employed, with such a percentage it’s very important to raise awareness about the ‘payments on account’ to the Self Assessment tax account which have to be made twice a year.

Creating such awareness is crucial for those who are new to the self-assessment system and usually miss out on the two deadlines, especially the second, which is due on 31st July of the tax year.

What do we intend to inform you about?

In this article, we intend to raise awareness for self-employed individuals whilst we also intend to enlighten you about the payments on account, how you are affected by it and whether you are liable to make a payment on account or not. If you are unsure about the payments on account, speak to your accountant, your accounting firm or your online accountants for more information. Our in-house tax accountants are also trained to guide you on all matters tax-related.

Who falls under HMRC’s Self-Assessment system?

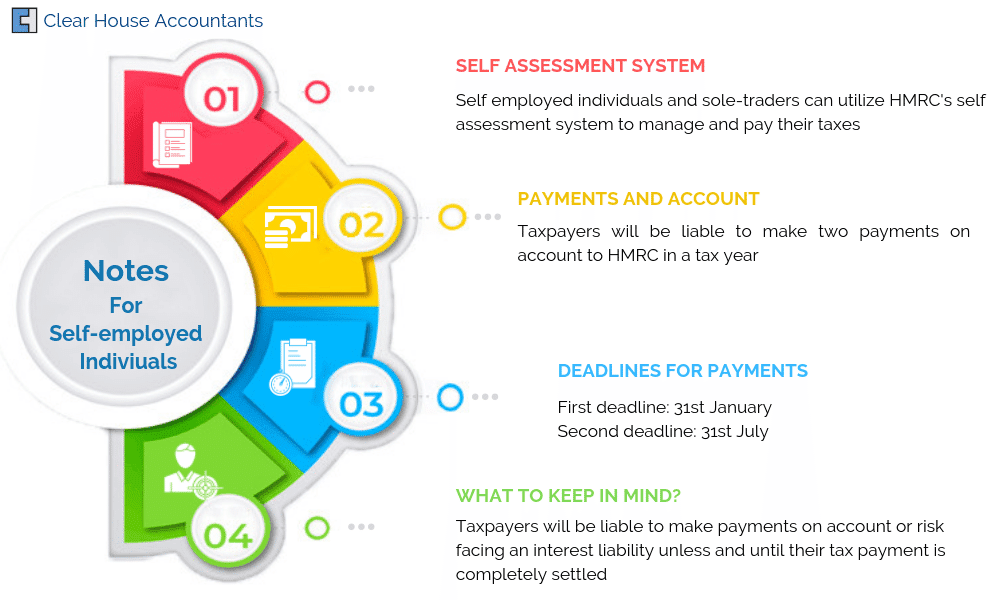

The HMRC’s Self Assessment system can be utilized by those taxpayers who have to personally manage their tax bills, mostly self-employed individuals and sole traders, and not by any PAYE-authorized employers and pension providers, in order to calculate and submit their annual tax returns.

The self-assessment system’s scope is not limited to self-employed individuals only but those individuals who have additional earnings besides their PAYE authorized employment, like rental income or income from a business that is out of the scope of PAYE, these individuals also have to register with the Self Assessment system and submit an annual tax return. The tax relief on expenses exceeding £2,500 in a tax year can be enjoyed by those who successfully complete and submit their annual tax returns.

When do you make the two payments on account under the Self Assessment system annually?

Under HMRC’s Self Assessment system, taxpayers are liable to make two payments on account to the HMRC as an advance tax payment for the taxes that are going to accumulate the following year. The first payment on account is due on 31st January whilst the second one, which usually frightens the self-employed taxpayers, is due on 31st July according to the Self Assessment system.

The 31st January deadline receives a lot of media attention, and for this reason, this deadline is rarely missed by the liable taxpayers, whilst the second, which is due on 31st July, receives far less coverage and is usually missed by most of the taxpayers, especially by those who are new to the Self Assessment System. If you have pending taxes to pay from the tax year 2018/19, you have to make a payment on account to HMRC. Your personal tax accountant should be sending you a payment schedule with your completed tax return. If you have not received this from your accountant, speak to them and get the payment schedule to avoid delays or penalties.

What do the taxpayers registered with the Self Assessment System need to be careful about?

As the trend of self-employment, contracting and freelancing is rising, a large volume of taxpayers are being pushed into the Self-Assessment regime due to which it is expected that most of the newcomers will find the system very confusing. Taxpayers need to realize that whilst they are settling their annual tax returns for the previous year, they also need to focus and work on making payments on account for the current tax year before the system’s deadline approaches. These taxpayers should know that they will be liable to make payments on account or risk facing an interest liability unless and until their tax return is completely settled.

It is advised that if you are a liable taxpayer to the Self Assessment system, you need to log in to the HMRC’s Self Assessment account to check whether you need to make payments on account or not. You may consult our in-house tax accountants to clear up any confusion you are facing.

How can HMRC assist you if there is any technical inconvenience?

HMRC’s Self-Assessment System has been a victim of technical issues in recent years and we can expect problems as with all technology. As HMRC has not sent any payment reminder to the taxpayers this year, it is feared that a number of individuals are unaware and will most likely miss the deadline that is due at the end of this month, 31st July.

You may request HMRC to reduce the payment on account demand if you are sure that you will have no taxes to pay for the tax year after which you have submitted a tax return. You can also request HMRC to inform you about the due payments if you are unaware of them. However, if you were not informed about the deadline on your liable payments on account due to technical errors, you are liable to pay interest charges on due taxes only if you didn’t seek assistance from HMRC before missing the deadline.

Clear house accountants are expert Accountants provider in London. Our In-house team of tax accountants are specially trained to help self-employed individuals and sole-traders stay compliant with all the tax regulations whilst ensuring that you stay updated with the latest tax reforms and deadlines. Our Personal tax accountants have been working with a large number of clients, helping them with their services to ensure that they save time and money efficiently.