Self-Employment Income Support Scheme?

The UK government announced various support schemes for businesses and self-employed individuals due to the disruption caused by the ongoing Covid-19 pandemic. Our COVID Support hub has been designed to help businesses in trouble; speak to us if you would like to know something specific. The primary objective of introducing these support programmes is to ensure that businesses are able to carry on with their daily business activities, generate revenues and survive for the next few months.

Self-Employment Income Support Scheme is one of the many programmes introduced by the UK government. This scheme is solely for self-employed individuals in the UK.

In this article, we intend to inform readers about the latest updates on the Self-employment Income Support Scheme and how you can apply for it. We have also listed down things you will need to apply to the programme successfully.

Latest update:

According to the notification released by the UK government, self-employed individuals who have already claimed for a grant through this programme can now file a second but final claim of up to £6,570. The second grant will be available in August, and self-employed individuals can claim a grant of about 70% of the average monthly profits that they made from their business. This grant can then be paid out in a single instalment, covering business profits for three months.

HMRC claims that self-employed individuals across the UK claimed about £340m within the first four hours from the launch of this support programme. HMRC believes that this support programme can support around 3.5m self-employed individuals by offering a cash grant worth up to £7,500, taking the eligibility under consideration, and has reached out to all of them. They say that they have sent out invitations to eligible individuals to claim their cash grant anytime between May 13 and May 18. They might be allowed to make claims at a later date.

The eligible individuals for the following support programme should have received an email, letter or text on behalf of HMRC. These emails or text messages are direct guidelines on how to make an online claim. The SEISS offers a taxable cash grant of up to 80% of the income of the self-employed individual, depending on the taxable profits they have earned over the past three years. These grants have an upper limit of £7500 over a three-month period.

It’s important to remember that only self-employed individuals who paid tax on business profits of up to £50,000 of their total earnings in the tax year 2018-19 can utilise this scheme.

Rishi Sunak, Chancellor of the Exchequer, claims that about 95% of people whose primary source of income is from self-employment will be covered under this support programme. He also added further in favour of the support programme by calling it one of the most generous schemes offered in the world.

What is the Self-Employed Income Support Scheme?

Here are some points to help you get a quick overview of the Self-Employment Income Support Scheme.

- This scheme can be claimed by any self-employed individual whose income was up to £50,000 as per their 2018-19 tax return.

- This scheme lets up to 80% of regular income to be capped at £7,500. However, you might have to pay Income tax and National Insurance.

- The scheme offers support similar to PAYE employees who are vulnerable to redundancy issues due to the ongoing pandemic.

- HMRC will send the cash grant directly into your bank account. You are not required to approach or contact the taxman for this.

- This scheme is strictly for those who have or are about to file a tax return for the tax year 2018-19

The following support programme offered by the UK government is somewhat similar to the support scheme offered by the Norway government. The scheme provided by the Norway government gives cash payment of about 80% of the average income the self-employed individuals have earned over the past three years.

The UK government understands the need to support self-employed individuals across the country during these uncertain times because 15% of the total UK workforce is composed of self-employed people, which makes it a separate sector that’s worth up to £305bn.

Related: Managing your finances as a self-employed individual is crucial for your business. Learn how you can use simplified expenses to reduce your administrative burden here for self employee.

Video: How To Claim Self-employment Income Support Scheme?

Watch the video to learn everything about the Self-employment Income Support Scheme.

What are the eligibility requirements to claim Self-Employed Income Support?

- You need to assess your eligibility by reviewing your latest tax return to ensure that you did not have more than £50,000 in trading profits, which should also be equal to your non-trading profits in the 18/19 tax return.

- Seek assistance from HMRC to utilise any other support for which you are eligible.

- You need to have a tax return filed for 2018/19.

- If HMRC has not contacted you and you believe that you are eligible to use the scheme, then you must approach HMRC by writing an application. HMRC will then check your eligibility by going through their records.

Our In-house tax specialists have confirmed that any individual claiming under this scheme must remember that this is not a tax-free payment. The cash grant will be considered as your business profits for the current year and will be subject to taxation along with the rest of your business profits via your Self-Assessment Tax Returns.

Before applying for the programme, you must check your eligibility early on. You can utilise an online tool offered by HMRC on their website to verify your eligibility to file a claim. You can also speak to a business accountant or business advisor to help you check your eligibility to make a claim.

Here is a list of items you’ll require to determine your eligibility for the programme

- Your National Insurance number

- Your Self Assessment Unique Taxpayer Reference (UTR) number

How much financial support can I expect?

HMRC will send a taxable cash grant into your bank account depending on your average trading profits for the following three tax years:

- Tax year 2016/17

- Tax year 2017/18

- Tax year 2018/19

Your average trading profit will be estimated by adding up your total trading profits or losses for the three tax years mentioned above and dividing the total profits or losses by three. The estimated amount of cash grant will then be paid by HMRC directly into your bank account in a single instalment.

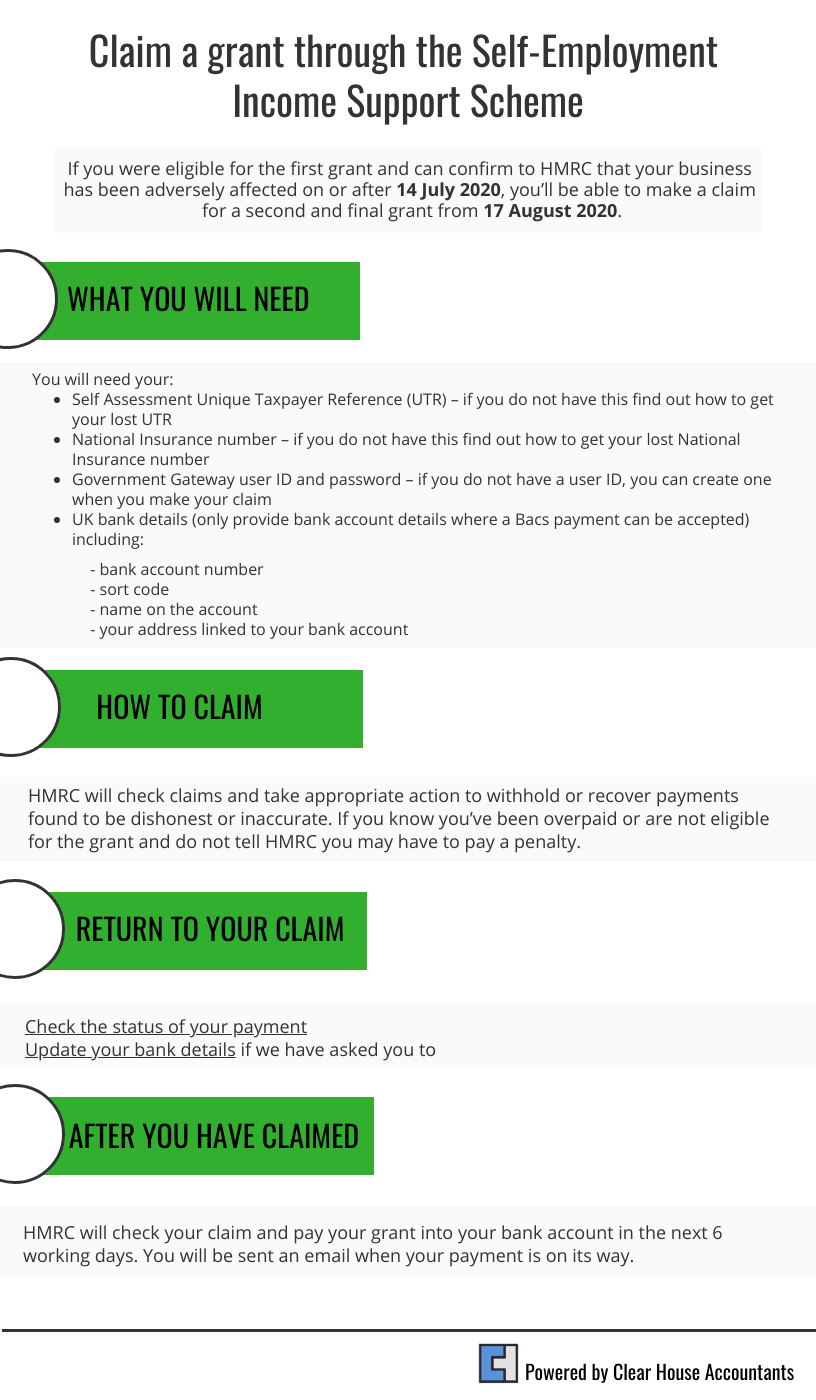

Checklist for filing a claim:

Here is a checklist to file an accurate claim for the Self-Employed Income Support Scheme:

- Your National Insurance number

- Your UTR number

- Government Gateway user ID and password

- Bank account number and sort code where you want the cash to be transferred. Ensure that you provide account details of a bank where Bacs payment is acceptable.

Will the scheme cover me if I have only just become self-employed?

Rishi Sunak has made it quite clear that the following support scheme will only be available for those who have filed their tax returns for the tax year 2018-19 to mitigate the risks of fraud.

A study estimates that at least 150,000 individuals who recently started working as self-employed will not be able to file a claim for the grant, as the scheme’s eligibility requires individuals to have their tax returns already filed for the tax year 2018-19.

Not only this but it is estimated that over 2m self-employed workers in the UK might not be eligible for the scheme due to the following reasons:

- They had average trading profits above the limit of £50,000

- They withdrew less than half of their total income from self-employment.

- They have not been involved in trading activities for long enough and have not been able to file the 2018-19 tax year returns on which the eligibility is primarily based.

I’m a self-employed individual with my own firm, will the scheme cover me?

It is imperative to note that this scheme does not intend to cover those who are owner-managers of their limited companies and earn a significant portion of their income via dividends.

Such owner-managers are believed to structure their company’s accounts in a manner that lets them extract around £800 per month via pay-as-you-earn (PAYE) but derive most of the income as taxable dividends.

The UK treasure has encouraged owner-managers to apply to furlough 80% of the PAYE aspect of their earnings by utilising the Coronavirus Job Retention scheme for salaried staff, which is another support program offered by the UK government. However, owner-directors must ensure that they aren’t involved in other trading activities if they want to use the opportunity. Anybody earning £800 per month via PAYE, the amount would then be equal to a monthly income of £640

Critics argue that these owner-managers are tax-paying individuals and are contributing generously towards the UK’s economy to help it get through the ongoing crisis, so they deserve the attention of the government in the form of financial support during these times. Some institutions believe that owner-directors should be offered support as dividends provide an evident paper trail to make a furlough claim of about 80% of their monthly taxable income, with a cap of £2500 per month.

In response, the UK treasury argues that it is almost impossible to investigate the dividends earned are from their own hard work or from investments made other than their own business. Adding to this, the UK government also believes that a portion of self-employed contractors have recently been engaged in tax avoidance practices by using personal service companies. Thus, they should not be offered financial assistance, according to the UK government.

Incoming tax trouble for self-employed individuals:

The Chancellor of the Exchequer has also stated that any self-employed individuals who currently pay less tax than those under the PAYE scheme might have to pay a higher rate of tax soon after the ongoing situation ends.

It is a well-known fact that the self-employed can save more money as they pay less income tax and National Insurance when compared to PAYE employees as their tax bills are worked out on tax-deductible profits. A study reveals that a self-employed worker earning a monthly income of £25,000 pays £300 less in National Insurance as compared to a PAYE employee working on the same amount of salary. The tax system also treats self-employment without any perks of paid holidays or job security due to which they end up paying less tax.

Clear House Accountants are professional Accountants in London who specialise in helping businesses, individuals, and partnerships. Our experts that provide specialist tax services have experience in assisting clients with various tax situations over the years, in order to help them save money while staying compliant.