Who is a Non Resident Landlord?

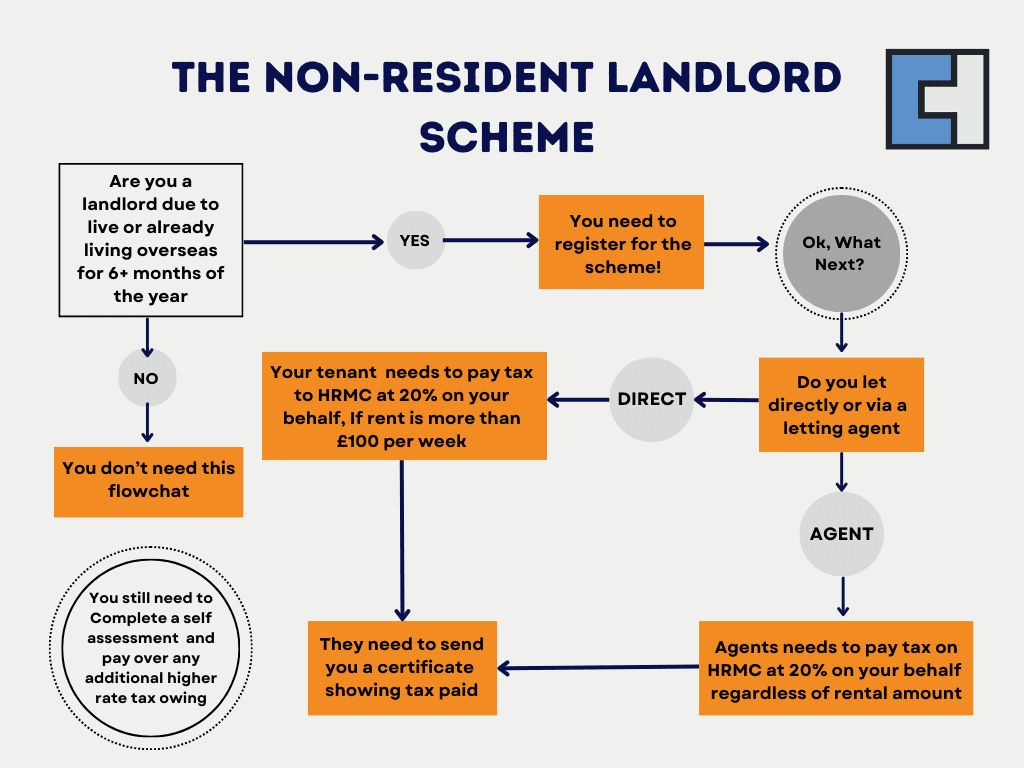

A non-resident landlord is defined as an individual, company, partnership, or trustee who owns rental property in the UK but lives outside the country. This distinction is crucial for tax purposes.

The NRLS: A Tax Scheme for Non Resident Landlords

The Non Resident Landlord Scheme, or NRLS, is a tax framework implemented by the UK government. It mandates that tax on rental income be deducted at the source when the landlord resides outside the UK. This responsibility falls on tenants or letting agents, who must withhold tax at the basic rate before remitting the rent to the landlord.

Criteria for Non-Residency

For tax purposes, landlords who haven’t lived in the UK for six months or more are considered non-residents. This classification triggers the application of NRLS rules. Our website provides more information about UK residency and the remittance basis if you are interested.

Tax Deduction Mechanism

If a landlord lives abroad, the tenant (if the rent is over £100 per week) or the letting agent is responsible for deducting tax from the rental income. A letting agent could be a solicitor, estate agent, personal tax accountant, or even a friend assisting in managing the rental property.

Compliance for Tenants and Letting Agents

Tenants and letting agents must register with HMRC under the NRLS. They are required to deduct tax and manage the associated administrative responsibilities.

Tax Calculation Process

Calculating the tax involves adding up three months’ rent, subtracting any deductible expenses, and then applying the basic income tax rate of 20% to the remaining amount.

Special Considerations

- Multiple Landlords: When a property is co-owned, the £100 threshold for rent is applied individually to each landlord.

- Multiple Tenants: If each tenant pays less than £100 per week, then NRLS does not apply.

Reporting and Payment Deadlines

Tax payments under the NRLS must be made within 30 days at the end of each tax quarter. Annual reports and certificates are also required to be submitted by specific deadlines.

Responsibilities of Non-Resident Landlords

Despite the NRLS, non-resident landlords must still file self-assessment tax returns in the UK. They can also apply for a tax exemption under certain conditions, such as having a clean tax record and no outstanding UK tax obligations.

Personal Allowance and Sovereign Immunity

Non-resident landlords may be eligible for personal allowances based on certain criteria like citizenship or tax treaties. Those with sovereign immunity have specific provisions for tax exemption.

The Role of Professional Assistance

Navigating the NRLS can be complex. Professional advice is beneficial for accurate tax return filing, understanding double taxation agreements, and managing allowable expense