Handling your business finances can get tricky and time-consuming if not handled properly. Research carried out by Finder showed that 23% of British adults have now opened digital banks, which equates to circa 12 million people. Make sure that the bank you select is registered with the Financial Conduct Authority before doing any further research before starting a business.

Managing cash flow for a business can not only get complex but can result in the business failing. Our guide to forecasting cash flow can be very useful if you are not sure how to plan for using your cash.

Why is it Important to Open a Separate Business Bank Account?

Another important factor in effective cash management is to have a separate business bank account from your personal bank. You will need a business bank account to manage your company’s money efficiently and to avoid mixing personal expenses with business expenses. Mixing these two can result in additional work to be done by your accountants which results in additional costs, it can also result in the scrutiny of your personal finances if HMRC investigates your business, as the banks are not separate.

Having worked with thousands of businesses, our accountants believe that separating personal finances from business money is the first step to excellent financial management. Not only does this help you get better control over your company’s cash flow, but it also helps you manage your taxes each year in a more efficient way and can also reduce accountant costs.

Benefits of Business Bank Accounts

Nowadays, banks offer several incentives for opening a business bank account. They usually couple them up with attractive deals to make themselves more welcoming. For example, they might offer you free business banking, zero-charge transactions, interest for holding money and overdraft fees. However, you have to be careful as these banks usually end up charging for every minor adjustment. There is also a big chance that you might end up paying more than what you receive.

After carefully analysing customer feedback and conducting detailed research, our in-house Business Accountants have curated a list of 10 best business bank accounts to use in the UK. These business accounts have been shortlisted in terms of interest, monthly fees, overdrafts, benefits and other important considerations.

We have divided the list into two main categories: high-street banks and digital banks. If you are interested in selecting a digital bank, we partner with a few digital banks and should be able to help.

Before we disclose the list, we would like to discuss what both of these types are and what functions they serve.

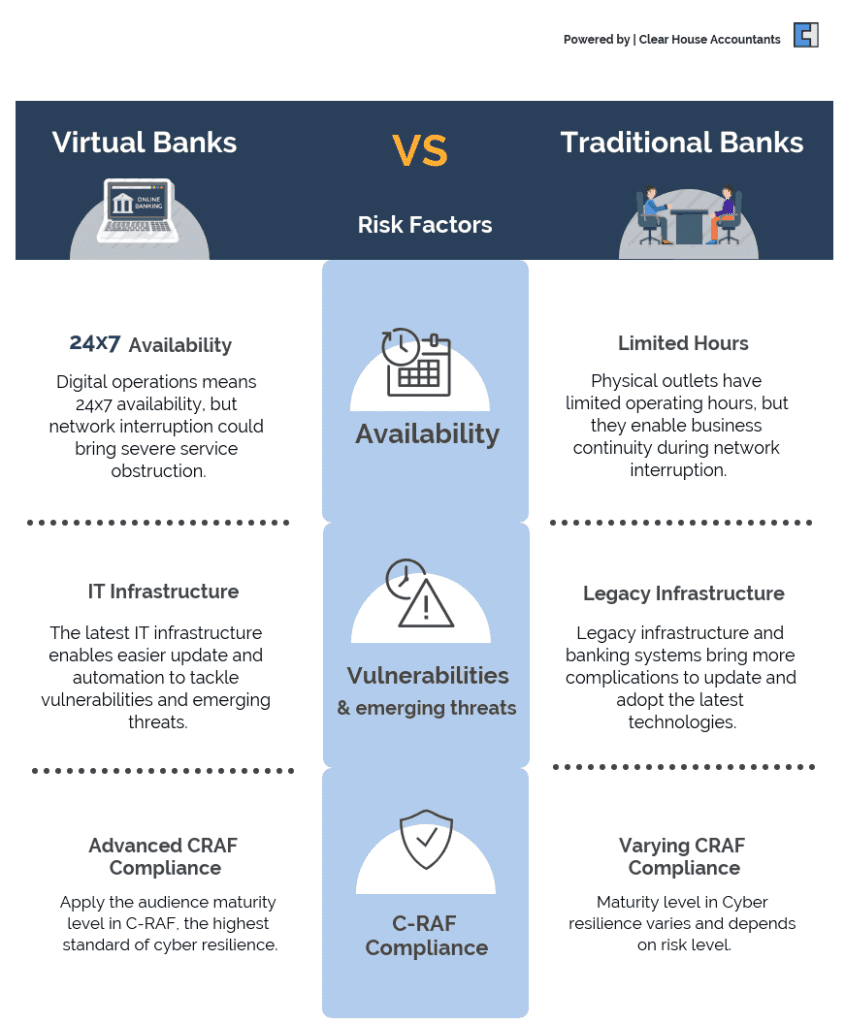

High Street Banks

The high street bank is a term used for large retail banks that have numerous branches across the country. The term ‘high street’ has been coined to help distinguish it from other bank types in the banking system, like investment banks or central banks. These banks cater to the general public or businesses of all types.

Digital-Only Banks

Digital-only banks offer their banking services via an application platform. The applications can be accessed through smartphones or the web. Digital banks do not have a physical branch or location from where they operate. They provide their banking facilities through real-time updates and automated processes. These banks also offer customer support through various built-in features within their application platform.

Digital-only banks are a great way to deal with your financial transactions virtually. With the freelance industry on the boom, millennials find it highly suitable to open digital bank accounts to keep up with their payment obligations.

If you are thinking about starting a business this year, here are some business startup ideas.

Digital-only banks have certain features that set them apart from ordinary banks. These include:

- 24/7 customer support.

- Cardholders have the flexibility to freeze/unfreeze their cards.

- Virtual Bank Cards

- Real-time transactions view

- Categorisation and reports on transactions spend

- Updates are provided via real-time notifications.

Related: How Cloud Software is changing the current competitive map for businesses to operate in.

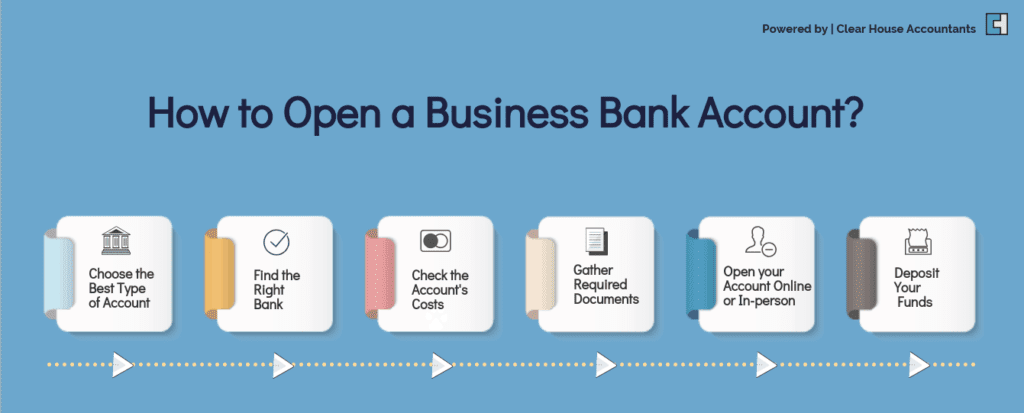

Video: How to Open a Business Bank Account in the UK

Watch the video to find out everything about opening a business bank account in the UK.

List of TOP High Street Banks

1. HSBC- Startup Business Account

Monthly charges: The first 18 months are free of charges/fees.

Overdraft: Offered at a negotiable rate.

AER interest: 0% on in-credit balances.

Benefits:

- Startups can utilise business banking services with no monthly fees for up to 18 months

- The online application alone can be used to open a bank account.

Important Considerations

- You can only avail of free banking services for 18 months if your annual turnover is not more than £ 2 million.

- The bank account can only be in the name of a person aged 18 & above.

- It may be subjected to certain terms and conditions.

2. Lloyds Bank- Startup Business Current Account

Monthly charges: The first 12 months are free of charges/fees.

Overdraft: 11.02%.

AER interest: 0% on in-credit balances.

Benefits:

- You may enjoy free business banking services for the first 12 months.

- 24/7 online and mobile banking facility.

Important Considerations

- You must ensure that your account is within creditable limits.

- Any overdrafts are subject to status.

3. TSB- Business Plus Account

Monthly charges: The first 6 months are free of charges/fee; £ 5/month will be applicable after the free period.

Overdraft: Overdraft facility is available.

AER interest: 0%.

Benefits:

- Free banking services for a period of up to 25 months.

- Free Square card reader facility which frees you from having to pay any charges on the first £1000 of transactions.

- You may switch to Business Plus within seven days.

- You will be provided free access to specialist digital advice.

- 24/7 uninterrupted online banking facility.

Important Considerations

- No annual dues.

- You may save cheque transaction charges.

- You may withdraw money from a cash machine.

4. Yorkshire bank-Startup / Switcher Business Current Account

Monthly charges: The first 25 months are free of charges/fees.

Overdraft: Offered at a negotiable rate.

AER interest: 0% on in-credit balances.

Benefits:

- The opportunity to avail of business banking services with no monthly fees for up to 25 months.

- No withdrawal, direct debit and cash/ cheque deposit charges.

- The online application can be completed within 15 minutes only.

- User-friendly application to make banking services easily accessible anywhere.

Important Considerations

- You may avail of free banking services for up to 25 months only if you open a business account within 12 months from its official launch and with an annual turnover not exceeding more than £ 2 million.

- There are limits to cash & borrowing.

5. Clydesdale Bank- Startup/ Switcher Business Current Account

Monthly charges: The first 25 months are free of charges/fees.

Overdraft: Offered at a negotiable rate.

AER interest: 0% on in-credit balances.

Benefits:

- Startups and switchers from other banks can avail of business banking services with no monthly fees for up to 25 months.

- Unlimited deposits and withdrawals, subject to available funds.

- You can apply online in just 15 minutes.

- You can avail of their user-friendly application for banking services.

Important Considerations

- You can avail of free banking services for up to 25 months only if you open a business account within 12 months from its official launch and with an annual turnover not exceeding more than £ 2 million.

- There are limits to cash & borrowing.

6. Co-operative Bank- Business Directplus Current Account

Monthly fee: The first 30 months are free of charges/fees.

Overdraft: Offered at a negotiable rate.

AER interest: 0% on in-credit balances.

Benefits:

- Startups and switchers from other banks can avail of business banking services with no monthly fees for the first 30 months.

- You may open your bank account online in less than 20 minutes.

- There are no monthly service charges if you hold a credit balance equal to or more than £1000.

- You may write up to 30 cheques per month, free of any charges.

- You may enjoy free automated debits that may include standing orders, faster payments, direct debits and debit card payments.

- Similar to automated debits, automated credits are also free.

- No additional charges for cash withdrawals.

- You are allowed to deposit £ 2000 in cash without any charges.

- You can deposit 100 cheques per month without any charges.

7. CardOne Bank- Business Account

Monthly charges: The first 3 months are free of charge. You will be charged £12.5 per month after the end of 3 months.

Overdraft: No overdraft service.

AER interest: 0% on in-credit balances.

Benefits:

- You may register through the online application form quickly and easily.

Important Considerations

- The application fee will cost you £55.

- You will not be given a chequebook when opening an account.

- There are no borrowing facilities like overdrafts, etc.

8. NatWest Startup Account

Monthly Charges: No charges in the starting 18 months.

Overdraft: is available subject to approval.

AER Interest: No information provided

Benefits:

- Easy and quick online application process.

- Opportunity to get transaction fee-free banking service for the period of the first 18 months.

- You will get a free Visa debit card.

- Business credit cards are available with no annual charges for the 1st year.

- Access to free accounting software.

- Access to 24/7 online banking via NatWest’s mobile banking app and telephone service.

Important Considerations

- Start-ups who have been in business for less than a year can get access to this account.

- Start-ups that have a predicted or existing annual turnover of less than a million pounds.

- The account can only be opened by an individual who is above the age of 18 and has a right to be self-employed in the UK.

- Personal details of all the partners and directors have to be provided when opening the account.

List of Recommended Digital-Only Banks

1. Tide- Business Current Account

Monthly charges: No monthly charges.

Overdraft: No overdraft service.

AER interest: 0% on in-credit balances.

Benefits:

- You may use the online portal to register yourself.

- You will not be required to submit any paperwork.

- Free of monthly charges and transaction fees.

Important Considerations

- There is an ATM fee for the withdrawal of cash.

- You will be charged a 20p per transaction charge on all transactions in or out of your tide account, tide to tide transfers cost nothing.

2. Revolut for Business- Business Current Account

Monthly charges: No monthly charges.

Overdraft: No overdraft service.

AER interest: 0% on in-credit balances.

Benefits:

- You may make multi-currency payments. You can hold up to 29 currencies and enjoy an interbank exchange rate (fee is applicable on the weekends only).

- Registration takes only a few minutes. You may integrate accounting tools like Xero or Quickbooks.

Important Considerations

- You can only avail of this account online

- Free plans are subject to limitations, Check terms and conditions

- There are charges of 0.5% for transfers that exceed £5,000 a month. You also get Free ATM withdrawals up to the amount of £ 200 per month anything above that is charged a 2% fee.

3. Cashplus Business Bank Account

Monthly charges: No monthly charges.

Overdraft: No overdraft service.

AER interest: 0% on in-credit balances

Benefits:

- Sign up in 4 minutes.

- Up to £15,000 Business Cash Advance to help small businesses with poor cash flow.

- 24/7 access to the bank account from any device.

- You can deposit cash into your account at any UK post office branch. The money will be available instantly.

- Integrates with Accounting software.

- Faster payments in and out through Online banking.

- Deposit and withdraw cash at the Post Office.

- 24-hour fraud monitoring of the account.

Important Considerations:

- There are charges of £2 on ATM (UK) withdrawals and 0.3% on cash deposits at UK Post Offices. Check their pricing plans in detail.

- Perfect for small businesses.

4. Starling Bank- Business Current Account

Monthly charges: No monthly charges.

Overdraft: 15%.

AER interest: 0% on in-credit balances.

Benefits:

- This account is best recommended for sole traders, small businesses and freelancers.

- Ideal for travelling purposes.

- This account can easily be integrated with accounting tools like FreeAgent & Xero.

Important Considerations

- You must be a UK resident to open this business account.

- Sole Traders can avail exclusive Soletrader accounts if they have a Starling Current Account.

5. Counting up Business Current Account

Monthly charges: 3 months of free subscription with free bank transfers if incoming funds are less than £500 per month. Transactional charges will be applicable after the first free 3 months. See their pricing page for more details and specific terms and conditions.

Overdraft: Overdraft facility is not available.

AER interest: 0%.

Benefits:

- Contrary to many other business accounts, this one offers bookkeeping.

- You may get your business account opened in 5 minutes without any credit checks and interviews

- Provides assistance in raising invoices and categorizing expense receipts.

- It allows you to manage your bills, profits and losses in real time with the help of the mobile application.

Important Considerations

- The limit for maximum account balance: For self-employed (£50,000), For limited organization (£120,000).

Clear House Accountants are innovative Accountants in London. We work with new and established businesses to help them create smart solutions to complex problems. Speak to us to learn more about how we can help your business.

Disclaimer: The details above are only correct as, on the 19th of February 2021, any changes in fees or features since then have not been reflected.