The concept of owning a business and being self-employed can have the same meaning but can have different connotations. You can be a freelancer, a contractor, a sole trader, or can own a limited company under the umbrella term of being self-employed. In simple terms, being self-employed can mean being your own boss. The notion of being a freelancer in the UK can be a challenging concept to grasp which can make it hard to understand the income tax implications one faces. Our specialist tax accountants for freelancers have curated a helpful guide to explain the different aspects of self-employment and, more specifically, relating to freelancing in the UK.

Freelancers in the UK

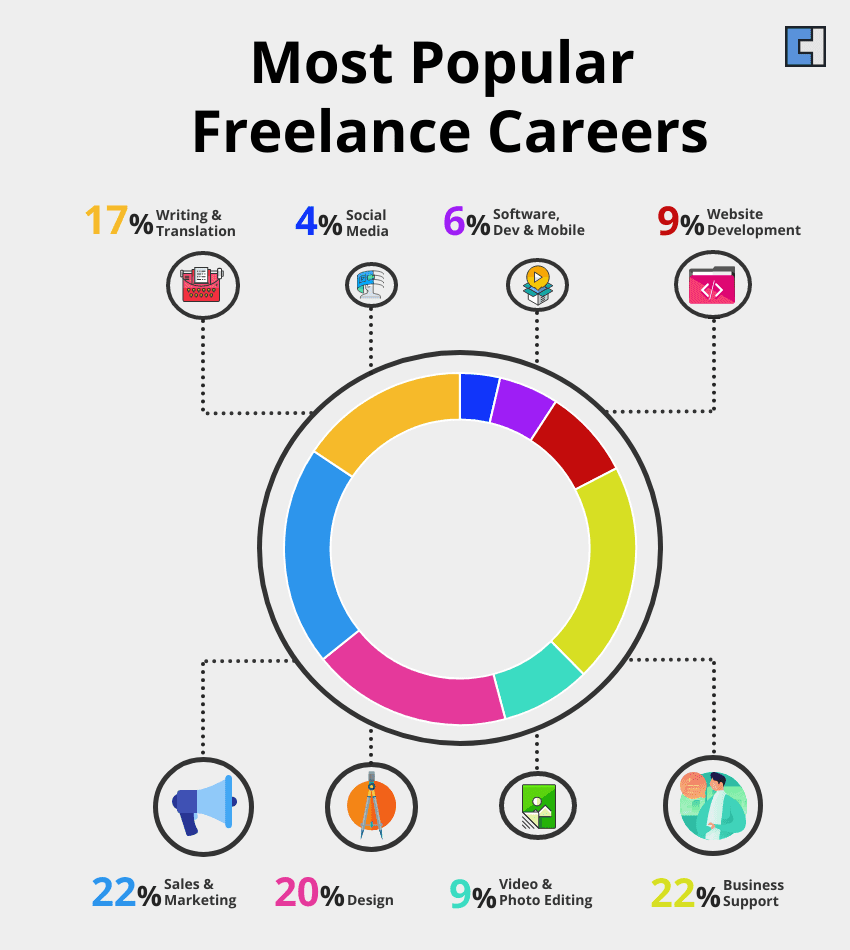

Freelancers can work on different projects with different customers at the same time, unlike contractors, who, in some cases, might have a contract signed forbidding them to work on more than one project or client. The term freelancer is most commonly used in creative industries like designers, musicians, writers, and others such industries. Mostly working solo, these individuals offer their skills as services to their customers and work on multiple contracts in exchange for a pre-decided fee.

In the UK, freelancing is one of the top three occupational categories which highly skilled individuals prefer. According to official records, the number of freelancers is continuously rising in the UK as there were more than 2.1 million freelancers in 2019. Among these, 2.1 million and 1.9 million were pursuing freelancing full time while some 234,000 freelancers were doing freelance work as their second job.

The incline towards freelancing in the UK is nowhere near its end, as more and more people are leaning towards self-employment and registering for HMRC self-assessment. Self-employment has a broader meaning than just being a freelancer in terms of the business or service being provided. A self-employed individual doesn’t need to be a freelancer; however, a freelancer is always mostly a self-employed person, someone who prefers working as their own employer. In terms of income tax, both freelancers and self-employed people are mostly taxed as sole traders unless self-employed individuals have other categories they have to self-assess, such as Property Income, Partnership Income, etc.

How to Become a Freelancer?

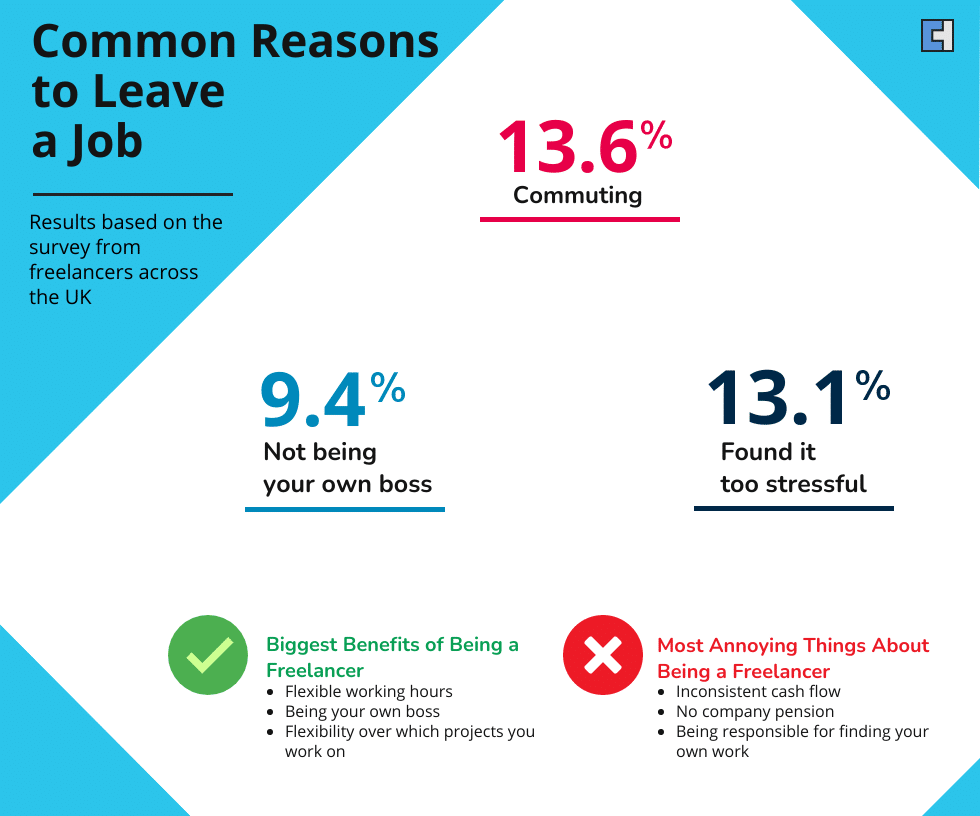

You might be considering freelancing because of unemployment, or you want to earn extra on the side or you want to avoid complex corporation tax. Whatever the reason is, you must ask yourself a few questions:

- Are you ready to do freelancing?

- Do you want to continue your current job and take freelancing as your second job?

- The skills to become a freelancer, do you have them?

- Do you have a plan to work with?

- Do you know how you will get customers?

If your answers second the idea of becoming a freelancer, then your first step towards your goal is to register yourself under an optimal business structure such as a Sole trader, Limited Company or Partnership. Most freelance workers and self-employed individuals are identified as sole traders in the UK regardless of the number of employees they have as an employer until they decide to open a limited company of their own.

If you have earned more than £1000 through freelancing or your business, you are obliged to register with HMRC as a sole trader for self-assessment. To register as a self-employed individual with HMRC, you need to inform HMRC that you will be paying taxes through self-assessment. The financial tax year for self-employed individuals and freelancers starts on 6th Apri,l and the deadline to register for self-assessment is 5 October following the previous tax year-end. For instance, if you started your business in August 2020, then you are required to register for self-assessment with HMRC before 5 October 2021, after the end of the tax year.

How do you pay taxes as a freelancer in the UK?

As a freelancer, HMRC income tax filing can get extremely complicated and stressful because of the multiple income streams that you may have, a lack of tax skills and the absence of understanding of how various things impact your income tax bill. If you are already registered as a sole proprietor with HMRC, then your tax liabilities would be the same as a sole trader. Similarly, if you want to work through your limited company as a freelancer, your compliances would be that of a limited company. It is because HMRC will tax on the basis of business structure (sole trader or limited company) and not on the working terms you may want to identify with. Therefore, it is important to understand the process of starting a business in the UK and its requirements.

Creative Freelancers Tax Duties

If you are a creative freelancer and have still not registered as a sole trader, begin by first assessing if you are eligible to file taxes as a freelancer or not. The income source of creative freelancers might be different from that of freelancers providing regular services. As a creative freelancer, your tax duty starts as soon as you make your first income. Whether you get paid for a number of subscriptions on YouTube or for selling a piece of art in an exhibition, you are liable to declare that income on your annual tax return accordingly.

If you do register as a sole trader with HMRC your tax amount may depend on the revenue you have made through freelancing and the deductible costs that you may claim. The profits, in the case of a freelancer, are the total income minus the allowable expenses you have incurred to continue your business. Once you have registered for a self-assessment tax return, you can claim multiple expenses if allowed. However, there is a certain amount that you need to earn before you are required to pay tax.

Personal Allowance

You can earn up to £12,500 in tax year 20/21 without worrying about any tax implications, UK citizens are allowed to earn this much money before they have to pay income tax. However, it might be different for individuals with different earnings, for instance, an individual who is earning £110,000 a year would have a tax-free personal allowance of up to £7,500, as personal allowance reduces for every pound earned above 100,000 pounds in a tax year.

The amount of income tax paid above the personal allowance depends on the total income you make in a year. There are different bands from the basic rate to top-rate tax, for the tax year 6 April 2020 to 5 April 2021, the bands are as follows.

- The basic rate tax is 20% of the total earnings

- Higher rate tax that is 40 % of the total earnings you make, more than £50,000

- Top rate tax that is 45% and is applicable if your income goes above £150,000

If you are pursuing freelancing as your second job along with your current job and collectively your earnings push you into the higher rate of tax, then the applicable tax on your earnings would be 40% on the proportion of your income that is more than £50,000.

How much tax is charged to freelancers, and how do you calculate the tax rate?

Let’s say John is employed in a graphic designing company as a junior graphic designer and is earning £35,000 per year. Moreover, John is also earning an additional £45,000 through freelancing work that he does online, with total expenses incurred on the freelance work of about £6,000 then the profit John is making through freelancing is £39,000 making his total income £74000 for the tax year. This pushes him into the high-rate tax band. In this case, the first £12,500 of taxable income would be treated as a personal allowance and would be exempted from any tax liabilities. The earnings between £12,500 to £50,000 would be taxed at the basic rate, which is 20%, and the £24,000 above that would be taxed at the higher rate of 40%.

It would be helpful to consult a tax accountant to determine how much you need to pay and what you can claim as expenses depending on your work. The costs you incur and deductible expenses that you can claim play a vital role in how much you or your business will pay in tax.

Allowable expenses as a Freelancer

Once you have determined whether you qualify to file tax as a freelancer in the UK or not, you will need to identify the costs that you need to incur to fulfil your daily business requirements. Creative freelancers, similar to self-employed individuals, can enjoy substantial tax breaks and reliefs, but only if they are successfully able to identify and declare all of the deductible expenses in their tax return.

Our tax accountants have listed down costs you can claim as business expenses to help you reduce the amount of tax payable. You can claim the majority of the expenses incurred if you run your business from home. You can easily claim costs such as electricity, heating, rent and many others when working from home. Claiming these expenses correctly is the tricky part, you can claim them based on the percentage of space you occupy to do your work along with the number of hours you dedicate to work each day.

List of Expenses You Can Claim as a Freelance Contractor to Reduce Tax:

Here is a list of allowable expenses that you can claim to reduce tax:

- Any tool that you require to complete your job, for instance, art stationery like pens, pencils or canvas. If you are a photographer, you can claim the high-tech lens you bought for your camera as an expense. Anything that adds an extra touch of creativity or value to your work has the potential, and you may claim that as an expense. It would be helpful in the long run if you keep a thorough track of all the tools and equipment you regularly use to get the job done.

- You can also claim travel costs as expenses even if you don’t have a car but still pay for public transport or Uber for meetings or purchases. If you have an office space, travel to and from the office is not allowable. Claiming travel expenses can be tricky, it is advisable to ask your accountant about the specifics.

- Your subcontractor’s or employee’s charges.

- Simplified Expenses that you can claim as self-employed

- Accounting consultancy and service fees.

- Commissions you pay on the sale of your work.

- Memberships or subscriptions (for business purposes).

- Fees for IT-related services for portfolio design and web development.

The list of items you can claim as expenses is very long and sometimes there are industry-specific expenses you can claim, speaking to a personal tax accountant can help you categorise all the things that you can claim as business expenses helping you do your taxes correctly.

VAT Treatment for Freelance Income

You will have to register your business for VAT if your annual turnover is more than £85,000. You can still voluntarily register for VAT, even if your annual revenue is not up to the required threshold. Voluntary registration will help in building a positive image of your business as well as reclaiming the VAT paid while purchasing goods and services. You can reclaim VAT if the tax you have paid while purchasing is more than what you have charged to your clients. VAT treatment for freelancers is not that different from sole traders or even Limited Companies; however, a specialised VAT accountant can help you understand any industry-specific VAT treatments and whether you can adopt a special VAT scheme or not, such as the Flat Rate scheme, the cash scheme etc.

National Insurance for the Self-Employed

There is another compliance that you must follow as a freelancer or a self-employed individual and that is the national insurance contributions. All employees, subject to certain conditions, pay national insurance in the UK to qualify for certain benefits in exchange for the state pension. The national insurance contributions depend on earnings, employment status, and source of income. For example, Class 1 national insurance is applicable to employees earning and working for an employer, this is deducted at source and paid to HMRC before the employer pays the salary.

For freelancers and Self-employed individuals, usually, class 2 and class 4 national insurance is applicable. You are obliged to pay Class 2 and 4 NIC if your profit is or exceeds £6,475, and £9,501 respectively in a year. If you are earning freelance income on the side and have permanent employment, then you will pay Class 1, 2, and 4 NIC depending on the income you collectively make. Consulting an income tax advisor will help you understand the complications regarding tax and national insurance for your particular case.

Freelancing as a Second Job

Throughout this guide, we have mentioned freelancing as a second job along with your current employment, so are there any rules that you have to follow if you earn an income other than through your regular job? The UK government does not prevent any individual from becoming a sole trader in their spare time. The rules might be different for an expatriate or someone on a specific type of visa. If you have a work visa, then it would be wise to check if you are allowed to work as a freelancer on projects other than your current job.

You can definitely pursue freelancing as a second job. However, you must separately register for self-assessment to pay your freelance tax. While registering online, you can disclose the tax you pay through PAYE accounts, and HMRC will then identify your taxable income, tax rates, and freelance tax liability.

Tax Tips for Freelancers

Storing Receipts will Keep Your Tax Game up

If you wish to stay calm during the tax season, the golden tip is to store and organise every qualifying receipt to file your annual tax returns error-free. Every single receipt can serve as a ticket to claim potential tax relief in the future, so keeping track of even those receipts which might not qualify as an expense later can help in the long run.

For receipts which you are unsure of, you can always speak to a personal tax accountant to help you decide if these should be included in your tax return or not. You should also pay attention to how you plan to keep these receipts safe. It might be helpful if you save hard and soft copies of every receipt you come across. For a paper receipt, you can always write the transaction purpose on the back to quickly check what it is actually for so that you know what these are for if HMRC investigates.

Utilise Cloud Accounting Software

Develop the habit of entering your business accounting information into accounting software regularly. If you do not have accounting software, then we advise you to talk to an accountant who can help you select the most compatible accounting software as per your business needs and what HMRC requires. Moreover, you can let the accountants complete your tax obligations.

Annual tax filing is a complicated and time-consuming process that demands full attention; hence, freelancers may find it very troublesome to allocate additional time for this tax process. Hiring a tax accountant can not only save time but also money through increased tax efficiencies. It may seem like an extra cost, however, the benefits associated with hiring an accountant will outweigh the costs. For instance, an experienced accountant can help you identify tax reliefs which you would have overlooked otherwise. Also, you can always claim your accountant’s fee as an expense in your tax return.

Tips to Protect Yourself Financially and Legally When Working as a Freelancer

Research Your Clients

You don’t need to accept the first project offered to you blindly, but instead, it’s wise to research the client first and check whether the client is honest or not. If you feel that the client doesn’t look so promising, you have the choice to reject the offer to work as a freelancer. Please do your homework and research everything you can about your potential clients before you sign any contract with them.

Always Have a Contract in Place

A contract is a type of document that guarantees an agreement between both parties to do work according to the terms and conditions mentioned. You should ensure that you have a specific contractual agreement with your client because the contract serves as a potential safeguard from financial and legal troubles.

Keep Proof of Work

A client can blame you for poor quality work done, which might impact your portfolio negatively. You can ensure this does not happen by keeping proof of work done by using monitoring software that enables the system to track your work progress and automatically takes screenshots of your work. They can also perform milestone-based work signed off by the client at frequent intervals.

Set up a Billing System

Setting up a billing system is one of the best ways you can protect yourself financially. A billing system allows an individual to track their due payments when working on multiple projects, and you also save yourself from the hassle of reminding every client individually. Moreover, you get more control over your cash flow and will be able to forecast whether you are going to run out of cash soon or not.

Conclusion

Successful freelance work is not just about being a good freelancer; we have worked with freelancers who are exceptional at their work, but by not selecting the right structure, not fulfilling their tax obligations properly and by spending too much time on irrelevant stuff, they end up with huge losses. This results in long-term failure, stress and poor returns on the work done, resulting in customer dissatisfaction. It is best if you research what you want to do and why you want to do it, and speak to an expert about tax, accounting, and business growth. Time is the most valuable commodity. Use it wisely and make decisions that pay off in the short and long term.