Do you own a small company or are a sole trader and wonder whether you must register for value-added tax and submit a VAT return? Our team of specialists have worked on curating a guide on the process of VAT returns for small businesses.

Value-added tax, or VAT, requires a basic understanding of the concept to avoid hefty bills and penalties from HMRC and to ensure that the products being sold or purchased have the correct treatment of VAT applied to them.

If your business’s annual revenue is below the threshold at which VAT registration becomes mandatory, you may still register voluntarily. Failure to register for VAT may result in severe penalties, including hefty fines if your firm meets the VAT registration threshold for small businesses.

Several aspects need your understanding for a successful small business, like: What is value-added tax? Can businesses claim it back? Do small firms have to pay value-added tax? Can sole traders claim back VAT?

Correctly handling value-added tax is crucial for every company. Let’s have a look at VAT returns for Small businesses.

You can also see our basic Guide on VAT for a basic understanding of VAT.

WHAT IS VALUE-ADDED TAX?

Value-added tax is a consumption tax that is always imposed on products when the value is added from the manufacturer up to the product’s sale. In some countries, this is referred to as goods and services tax or GST.

This tax is usually imposed directly on the rise in the value of products or services at each production and distribution cycle. Hiring a VAT specialist to manage this, such as a VAT Accounting, will potentially reduce the complications in collecting and reporting this tax in your country.

VAT might not be charged on all goods and services. Duty-free items are mostly exempt or reduced for VAT and customs. Nevertheless, it is somehow regarded as a destination-based tax whereby the tax rate is usually based on the consumer’s location and the sales price.

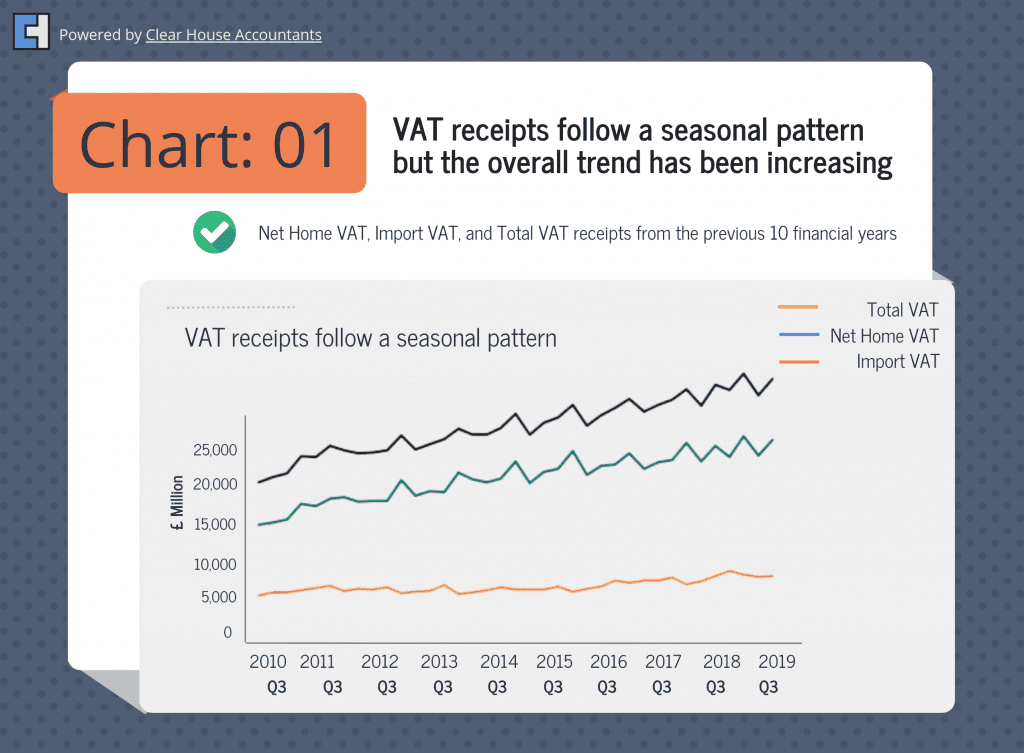

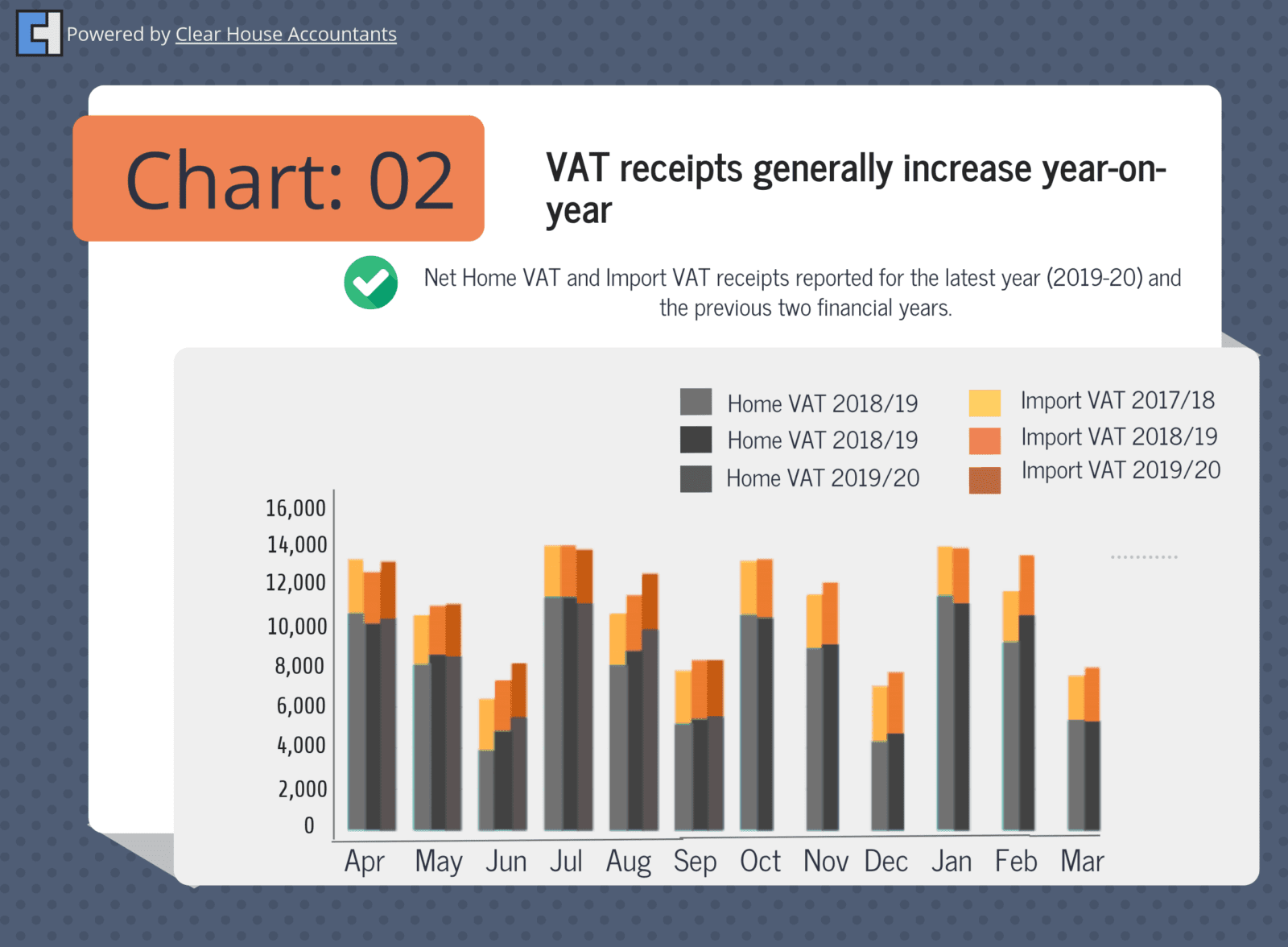

Statistics clearly show an increasing trend in the collection of VAT receipts helping to raise a huge percentage of the total tax revenues in the UK. In the UK alone, it plays a significant role in generating the third-largest revenue for the government behind National Insurance and Income Tax, a study by the Institute of Fiscal Studies confirmed.

As a business under the VAT threshold, you need to make sure you understand how it is applied to your products, your sales and your purchases, speaking to a good VAT accountant and setting baseline systems to record, monitor and report VAT should be a very important step for your business. This is especially important since the introduction of Making Tax Digital for VAT.

What Is My VAT Registration Number?

If you’re confused about how to get a VAT number, then do not worry.

You may find the VAT identification number for your company on your VAT registration certificate, which is only issued to businesses registered for VAT.

This crucial document will also specify the date your firm crossed the barrier for UK VAT registration and, therefore, became obligated to register. You can understand what happens if you don’t register for VAT.

What Is the VAT Threshold for Businesses?

The yearly turnover of your firm is more important than its size for determining whether or not it must pay value-added tax. The value at which value-added tax becomes applicable. The minimum taxable amount in the UK is £85,000 (2023-2024). You must register if you realize that your business’s yearly turnover exceeds this threshold. Failure to do so in 30 days will amount to a fine you must pay.

Because of this, you will have to add VAT on whatever your company sells if it is a vatable item. Keep in mind that only VAT-registered businesses may collect VAT from customers. Whether a business is structured as a Limited Company or a sole proprietorship, regardless of whether or not it is subject to corporation tax, it must register for VAT.

When do you have to pay VAT?

Try and make effective use of accounting software to help you monitor your turnover in a bid to know when you are about to hit the threshold; it is advisable to use a VAT Accounting Firm that has expertise in the use of modern software and technology and specialises in value-added tax.

The Value-added tax turnover is calculated based on a rolling 12-month basis from any given point that is not based entirely on a calendar year. In short, you need to register when your turnover exceeds the threshold ( £ 85,000). Registering for VAT can also be voluntary, depending on your business circumstances. Otherwise, you must register for Value Added Tax when you:

- Buy, Purchase or get in control of a business that is already registered for VAT

- Sell products and services that are already exempted from VAT

- Will start supplying goods or services in the United Kingdom or will do so in the following 30 days.

The UK VAT rates

- The Standard Rate: Its rate is 20% and applies to all other goods and services taxable in the UK.

- The Reduced Rate: At 5%, the Reduced Rate is applicable for goods such as children’s car seats, electricity, certain social housing, natural gas, some social services, and district heating supplies for domestic use only. Under this rate, energy-saving domestic installations, LPG and heating oil for domestic use, repairs and renovations for some private dwellings, and medical equipment for the disabled are also covered.

- The Zero Rate: This rate stands at 0%, and it covers printed books except for e-books, newspapers and periodicals, some social housing, renovations to private dwellings, household water supplies, collection of domestic refuse, basic foodstuffs except pre-cooked food, take away food, prescribed pharmaceutical products, cut flowers, children’s footwear and clothing, seed supplies and so on. Even though there are no charges on zero rates, the sale of goods and services under this category should always be recorded, and the report should be prepared based on your return.

You must be aware of emerging rate changes, especially when calculating VAT. This is why it is recommended that you keep up to date with the information regarding the latest rates to ensure that your accounts and invoices are accurate. A VAT calculation can get complex; our trained VAT Accounting service is developed to help you with all Value Added Tax-related matters.

What Is the Deadline for Filing a VAT Return?

The amount of value-added tax (VAT) collected from customers and the sum billed by suppliers must be reported to HMRC by all businesses that collect and remit VAT. Your VAT return is where you’ll report this information.

The net of Input and Output VAT reported on the return with the net payment, if any is due, must be reported and paid to HMRC 1 month and 1 week after the quarter ends; this process has to be followed every quarter.

The exact due dates may vary based on when you filed and whether or not you selected a staggered schedule. If you want more frequent submission and payment of VAT, you may also submit a request for returns every month.

The VAT portal is where you can see your upcoming deadlines.

How to Register for VAT

Register for VAT online using a Government Gateway user ID and password. If you don’t already have a user ID, you can create one when you sign in for the first time.

You can appoint a VAT accountant or agent to handle your VAT Returns and communicate with HMRC. Even if you use an agent, you can still sign up for a VAT online account once you receive your VAT number.

The specific information required for VAT registration varies depending on the nature of your business.

If you are a limited company

You’ll need:

- The company name

- Details of turnover and nature of business

- Bank account details

- Company Registration Number

- Unique Tax Reference (UTR) number

You’ll also need to give information about your:

- Corporation Tax

- Pay As You Earn (PAYE)

- Self Assessment

If you are an individual or partnership, You’ll need:

- Date of birth

- National Insurance number

- ID such as a passport or driving license

- Details of turnover and nature of business

- Bank account details

You do not need a Self Assessment UTR to register for VAT, but if you have one, you must provide it.

You’ll also need to give information about your:

- Payslips

- P60

- Self Assessment return

How do you Sign up for an online VAT account?

To register for a VAT online account, you will receive the following after completing the registration process:

- A 9-digit VAT number must be included on all your invoices.

- Instructions on how to set up your business tax account if you still need to get one. This account is necessary to access the VAT online service.

- Details about when to submit your initial VAT return and make the corresponding payment.

- Confirmation of your registration date, also referred to as your ‘effective date of registration’.

How to Register for VAT By Post?

If online registration is not possible, you must register by post using the following forms in specific circumstances:

Use form VAT1 if:

- You wish to apply for a ‘registration exception.’

- You are joining the Agricultural Flat Rate Scheme.

- You are registering a group of corporates or businesses under one unit with separate VAT numbers.

- Use form VAT1A if you are an EU business engaging in ‘distance selling’ to Northern Ireland.

Use form VAT1B if you import (or ‘acquire’) goods into Northern Ireland valued at over £85,000 from an EU country.

Use form VAT1C if you dispose of assets and have claimed Directive refunds.

Once you receive your VAT number from HMRC, you can sign up for a VAT online account by selecting the option ‘VAT submit returns.’

Accounting for VAT

Registering for VAT is just the first step, as once registered, you, as a business owner, will need to add the relevant VAT rate on all of the taxable sales of the business as an output tax. Your customers would be paying the VAT. Still, a business’s responsible for registering for VAT, reporting accurately and timely, and paying VAT to HMRC.

How to Calculate VAT?

The VAT is always paid when we purchase, regardless of whether we want a new TV or have a quick lunch.

The value-added tax is a consumption tax (VAT). As the name suggests, the consumer is responsible for the cost. Usually, the consumer is the final user. Before continuing, let’s examine how UK tax rates are applied to computations and invoices.

Consider that you go food shopping and spend £1.20 on a beer. Afterwards, you would pay your beverage taxes of £0.20 and £1.00. The grocery store accepts cash and gives the government £0.20 in taxes. The £1 is kept by the store. The full expense is your responsibility as the consumer, priced at £1.20. To understand VAT on Food, read our complete guide.

Important Note: While Calculating Tax

The worth of a commodity or service, not its quantity, is used to calculate VAT (in contrast to excise duty). For instance, a merchant must calculate the selling price before adding VAT to sell a bicycle. He multiplies the selling price by the appropriate VAT rate to calculate the amount of VAT to charge. The ultimate purchase price is calculated by adding this to his asking price. The retailer submits the VAT to the Tax and Customs Administration when the bicycle is sold.

VAT Record-Keeping requirements

Every VAT-registered business must

- Keep all records of purchases and sales

- Keep a summary of their VAT account

- Issue the right VAT invoices.

In addition, you must keep your VAT records for a period of not less than six years. These records can be kept electronically, on paper, or in a software program. Your records should be accurate, readable, complete, and easily understood. Records that you need to keep must include the following:

- Copies of the invoices you issue

- Invoices received

- Sell-billing agreements

- The names, addresses and VAT numbers of the self-billing suppliers

- Debit/credit notes

- Imports and export records

- Records of goods you can’t reclaim their VAT on

- Records of received and dispatched goods

- VAT account On top of that, you need to keep records of bank statements, cheque stubs, cash books, till rolls and paying-in slips.

Pros of Submitting VAT Returns

It may seem insignificant, but having your VAT registration number on your company’s paperwork, online profiles, and paperwork will help you in the long run. It may improve people’s perception of your company and make them more likely to do business with you.

Value-added Tax Refund

The possibility of being refunded VAT paid on company purchases is another benefit of voluntarily registering for Value Added Tax. You may be eligible for a VAT refund from HMRC if you sell one kind of VAT-rated goods (such as zero-rated) and purchase another (standard-rated).

It would be best to weigh it against the value-added tax your company collects from its customers. You may be eligible to claim VAT if you have invested in machinery, computers, and other equipment.

Past VAT Payments May Be Refunded

How far back can you claim VAT?

You may get your VAT back for the last four years if you voluntarily register for VAT. If you’ve been using an item for more than four years and purchased it inside the European Union, you may be refunded the VAT you paid by registering for Value Added Tax.

As long as you have maintained the appropriate VAT records and invoices, you may still recover VAT even if your firm has been operating for some time but has yet to reach the threshold.

Save Money and Stay Out of Trouble

Keep an eye on your sales figures to ensure you get all the points when registering for Value Added Tax, as your company might face a hefty penalty.

When you voluntarily register for VAT, you save the hassle of meeting the threshold and providing timely notification to HMRC. VAT registration is entirely optional and may be completed at any time.

Simple Commercial Transactions

In today’s economic environment, many vendors and organisations will only work with enterprises and SMEs that are VAT-registered. Many will only do business with you if you provide a valid VAT invoice.

You may get a VAT number and streamline your interactions with other firms by registering for VAT voluntarily.

Disadvantages of VAT Returns

Problems With Paperwork

If your company is subject to value-added tax, you must follow specific procedures and preserve certain records. Registering your company for Value-Added Tax (VAT) adds another chore and a mountain of paperwork. VAT registration might be complicated if you need to know what you’re doing, so it’s a good idea to get some help if you need clarification on the rules.

Finance Disruption

A VAT charge might appear out of the blue. There will almost always be a discrepancy between your output and input VAT; if that happens, you’ll have to pay the difference to HMRC. If you aren’t expecting a charge for VAT, it might disrupt your finances.

How to Claim a VAT Refund in the UK?

By reporting the value-added tax (VAT) you’ve collected from customers and disbursed to suppliers, you’re helping the tax man track your company’s finances. A VAT return must be submitted to HMRC at least every three months.

To comply with Making Tax Digital, you must retain digital VAT records and submit your return using accounting software.

Timely submission of your VAT return can save you from receiving points against you and late payment fees.

Businesses can reclaim VAT paid or input tax on products purchased for business purposes. However, there are some conditions for such options as purchasing or cost incurred on business entertainment or car purchasing for private use is not an allowable cost to reclaim VAT. Knowing VAT on used cars is imperative if you plan to purchase one.

You can claim pre-registration VAT, but it can be tricky as HMRC’s guidance isn’t very transparent.

Obligations – VAT Returns For Small Businesses

If your firm is VAT-registered, you must collect VAT from customers when they buy your products or use your services, and you may get the VAT back when you make business purchases. VAT invoices containing sales tax must be provided by businesses whenever a transaction is made.

Except for in-person transactions, when a simple receipt for the purchased item is sufficient, this rule holds for all online purchases. Each consumer who requests a receipt is still entitled to a VAT receipt from the firm.

Your company’s VAT rate applies to the purchase price of goods and services. Whether you operate on an exchange or partial exchange basis, It must include VAT in your sales. HMRC will still consider the sales price you charge to include VAT, even if you do not.

Businesses registered for value-added tax must file a VAT return with HRMC once every three months detailing the value-added tax collected and remitted. No VAT to report? You still need to fill this out.

If you charge a consumer too much in VAT, you’ll have to pay the tax man. You might get your money back from the government if you overpaid on VAT while your clients paid less.

Mistakes in VAT Returns for Small Businesses:

Gas and Auto VAT Refunds

Directors, partners, and staff may recover the value-added tax they paid on gasoline used during business operations when submitted VAT returns.

A frequent VAT return blunder occurs when gas for both company and personal usage is claimed on the return. It is prevalent when a vehicle is used for both work and pleasure.

When claiming gasoline costs from HMRC, you must provide proof in the form of detailed mileage logs; if this proves too demanding, you may instead choose to pay a scale fee as an output tax.

Exempting Certain Items from VAT

Everyday items subject to value-added tax in businesses include inventory and office supplies.

It is common practice to improperly account for and recoup VAT on expenses, cash sales, revenue from real estate, service charges, and barter transactions.

Remember to call attention to any unusual or out-of-the-ordinary deals you’ve been working on so you can make sure they’re getting the proper attention.

Claiming VAT Exemption on Partly or Fully Zero-Rated Purchases.

You may recoup VAT on all business costs, given the standard VAT rate (20%) is already built into many of the essential and frequent acquisitions you make on behalf of your company. However, it is only sometimes the case that certain purchases are not subject to value-added tax; for example, the sale, lease, or rental of commercial property or structures and membership fees paid to organisations.

Cashing In VAT Refunds without Supporting Documents

VAT invoices must be proof of claiming input tax credits for business costs. Thus, before you file your tax return, you must ensure that all of your documentation is in order and that you have followed up on any pending or overdue bills.

HMRC may accept other proof, such as a bank statement, without a VAT invoice if it shows that you paid the supplier.

But, if proof is lacking, you should discount the assertion.

Overclaiming on VAT Paid on Imports

Falsely claiming VAT upon receiving invoices from shipping firms is the most common mistake with import VAT. These receipts are valid. However, they only cover the agent’s fees and not the import VAT that must be included when filing for a refund.

You can refund VAT paid on imports if you have received a valid import VAT certificate (C79) from HMRC. The typical time frame for UK product delivery by agencies was three weeks following the end of the month. This has now been replaced with postponed accounting for VAT.

Stay Abreast of HMRC Updates

VAT has constant changes and additions of new VAT schemes. Two developments, the changes to the flat-rate scheme and the introduction of Making Tax Digital, have altered the VAT landscape for many enterprises and individuals.

Conclusion:

In conclusion, understanding VAT returns for small businesses is essential for all entrepreneurs and sole traders. Value-added tax plays a significant role in the financial landscape, generating a substantial portion of the total tax revenues in the UK. Whether your business is below the mandatory VAT registration threshold or not, it is vital to comprehend the concept of VAT to avoid penalties and hefty fines from HMRC.

Voluntary VAT registration can offer advantages such as the possibility of VAT refunds, improved credibility, and simplified commercial transactions. However, it also comes with its challenges, such as paperwork and financial disruptions. It is crucial to keep accurate records, follow the rules, and stay updated on HMRC changes to avoid mistakes in VAT returns.

Before registering for VAT and submitting their VAT returns, entrepreneurs should thoroughly educate themselves about the process and consider seeking professional assistance from VAT specialists or accountants. Small businesses can efficiently manage their VAT obligations and ensure compliance with tax regulations, contributing to their overall success and growth in the long run.