Learn how outsourcing your Bookkeeping can help you Grow your Business

We believe the 21st century is the digital age that has seen rapid innovations and immense technological breakthroughs. As per Statista, global spending on technology has reached 3,360 billion dollars. We have had amazing innovations such as Amazon, Facebook, Google, Self-Driving cars, and remote services such as outsourcing things like Bookkeeping Services, IT, or other virtual services.

Some believe that the digital age is simply a modified version of the industrial age powered by sophisticated gadgets and information technology, leading to the globalisation of the world.

Thanks to the digital age!

With a single tap of your phone, you can stream through millions of datasets and avail yourself of many services, from grocery shopping and bill payments to online banking and outsourcing.

This age has brought world-class facilities to your doorstep and has provided several incentives for young individuals attempting to turn their dreams into reality. Young individuals such as entrepreneurs have the opportunity to double their net worth, unlike the businessmen from the previous era (before the 1980s).

With everything going online, business communication has reached a whole new level. It has allowed entrepreneurs to research, market and sell their products while sitting on their couch at home.

The rise in outsourcing trend:

Cutting-edge technologies have made it easier for businesses to operate in the market. Advanced tech-induced business practices have triggered new motivation among small businesses and startup owners.

For instance, Instant access to the company’s financial data online, regardless of the geography, has increased the desire among new entrepreneurs to start outsourcing their key business responsibilities to experts, say, accountants or bookkeeping firms, with their accounting, admin or bookkeeping responsibilities, while they focus on the product and growing their business.

Related: If you are unsure about hiring an accountant, why not read When to Hire an Accountant?

With a lack of funds and resources, it might be important for startup businesses to keep their costs low by outsourcing their accounting services to a bookkeeper or an accounting firm. Not only will they get great bookkeeping, accounting or admin services, but they will also increase efficiency, save costs by avoiding errors and grow quicker by utilising time more effectively.

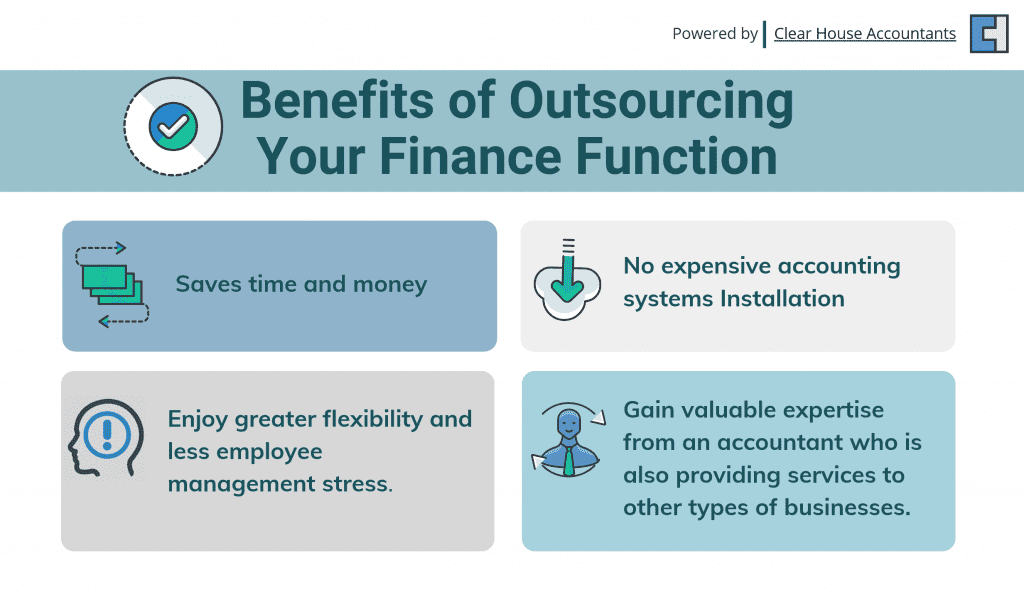

Benefits of outsourcing bookkeeping to grow your business:

Startups are now seeking to outsource their bookkeeping obligations to accountants or bookkeeping specialists because of its multiple advantages.

You need to save yourself enough time to work on your growth strategies and business policies and give your business the chance it deserves to grow its best. Learn how outsourcing can help improve your business performance.

Money, you get to keep more of it.

By outsourcing your bookkeeping responsibilities to an online accountancy firm, you save a lot of funds by avoiding potential mistakes and saving time, as experts can do what they are best at better and faster than if you were to do it yourself.

The clock is ticking; stop wasting your time

What’s the point of being an entrepreneur if you’re always worried about little things and responsibilities when you can delegate them to an expert? If you believe bookkeeping, IT, or marketing are not your cup of tea, stop spending your precious time on work that could be done by outsourcing rather than or hiring a full-time employee.

Related: If you still want to do your bookkeeping, why not read tips on improving your bookkeeping?

Expertise at the best price

Outsourcing Bookkeeping services to a professional means you enjoy fruitful business advice without hiring an expensive specialist full-time as an employee. Complicated employment rules will not bind you.

The service package may include typical accounting and bookkeeping services with additional guidelines on compliance every week. Your consultants get paid when they provide a service; employees get paid regardless, and removing them might be complicated.

Potential to increase profitability

Every entrepreneur dreams of achieving their business dreams with minimal costs and friction. By outsourcing your bookkeeping responsibilities to a capable bookkeeper, you reduce your business’s running and payroll costs and increase your business’s potential to expand its operations successfully.

Besides, outsourcing your financial work to an online bookkeeper can allow you to work out your finances more efficiently and flexibly. It also leaves room for open communication between you and your accountant per your needs.

This might be different with an in-house bookkeeper, as it is more likely that he will stick tightly with his work hours.

Small business owners can improve their competitiveness by applying our customised tips.

No need to spend on expensive accounting systems

Accounting and Bookkeeping firms employ the latest technologies as part of their accounting systems, with built-in automated features to handle complex financial scenarios. The most advanced technologies are employed because these service firms are tasked to deal with multiple client scenarios.

Using the latest technology with built-in automated features enables accounting firms to provide their clients with the most efficient way to store, update and present complex business data to key stakeholders.

Clear House Accountants are specialist London Accountants and Bookkeepers with years of experience working with businesses, helping them outsource key parts of their business such as Accounting, Tax or Bookkeeping to improve financial efficiency and reduce costs.