Starling Bank Partnership: Leading Collaboration

Who Are Starling Bank?

We are delighted to announce that we have joined the Starling Bank Partnership program, which has been crowned the title of “Best Bank In The UK” for three consecutive years. As one of the most acclaimed banks by small businesses, sole traders, and limited companies, Starling Bank has quickly become the bank of choice for more than 380,000 businesses in the UK.

Founded in 2014 by Anne Boden, Starling is the UK’s first mobile bank offering super-fast setup, beautifully simple money management and 24/7 support, all with no monthly fees. From small businesses with big ambitions to freelancers figuring out tax returns, Starling’s award-winning business bank account is designed to make entrepreneurial life a little easier.

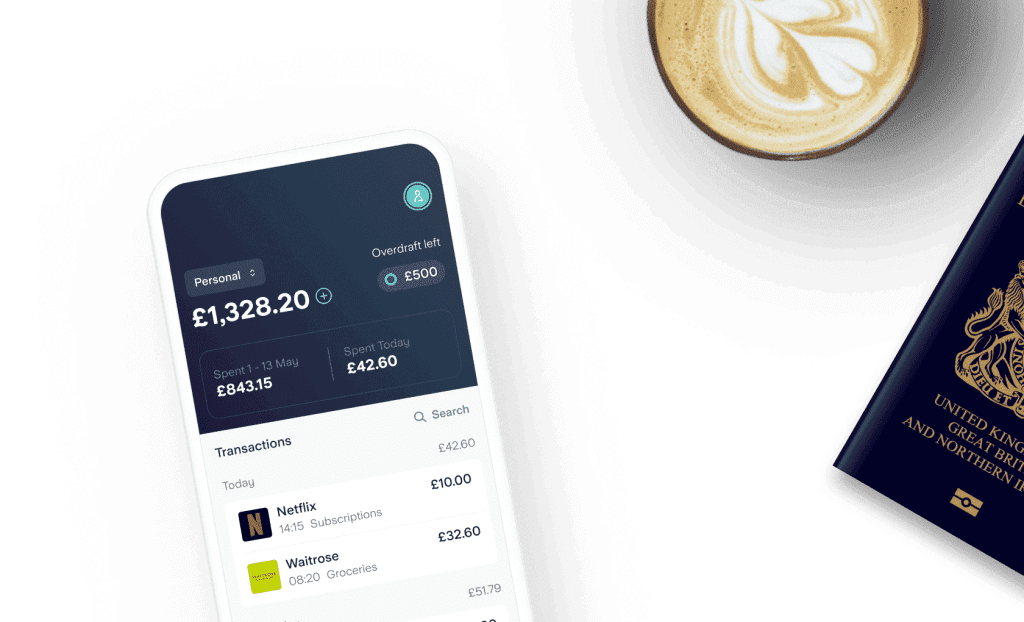

- No monthly account fees.

- Apply in minutes, from your mobile

- Integrate with Xero, QuickBooks and Free Agent 24/7 UK customer support, from our UK-based team

- Stay in the know with real-time payment alerts and categorised transactions for spending insights

- Deposit money at over 11,500 post office branches. Deposit cheques via Freepost or by scanning them in the app

- FSCS protection: We’re a fully registered bank and the FSCS protects any money you keep with us up to £85,000 for eligible customers

Who’s Eligible For A Starling Business Bank Account?

- You’re the owner of a limited company, and you’re the only person with significant control (PSC) over it.

- You’re the PSC of a limited company or LLP with multiple owners. With our multi-PSC account, you and your fellow PSCs will each get a Mastercard debit card and access to a beautifully simple mobile bank account. Please note that all PSCs registered at Companies House need to be UK resident individuals (i.e. no corporate shareholders). They can only provide access to the account if you’re a director registered at Companies House and a UK resident. For more information, read our blog post titled: ‘Introducing: Multi-owner mobile business accounts for limited companies‘.

- You’re self-employed. Our sole trader account is available exclusively to those who already have a Starling Bank personal account.

- Entities engaged in or linked in any way to, certain activities may not be able to open or have a business bank account with Starling. Check our Business Current Account Terms for more information.

Apply In Minutes

It is Easier Than Ever Getting Started

- Click on your accountant’s application link

- Download the app from Google Play Store or the App Store

- Enter your personal details

- Verify who you are by uploading your identification documents and sending us a short video

- We’ll carry out some quick checks at a UK Credit Reference Agency

- Provide a few details about your business, such as its day-to-day activities and online presence

- We will then look to approve your application as soon as possible!

Get An Instant Quote For Our Services!

Save Time And Money While Staying Compliant.

Link Your Accounting Software

- From the ‘Account’ menu, go to the Starling Business Marketplace

- Tap ‘Accounting’ and then find Xero, QuickBooks or FreeAgent

- Tap ‘Add’, authorise access, set up the account on Xero, QuickBooks or FreeAgent – and that’s it!