Understand how Advisory Fuel Rate works

What do you need to know about Advisory Fuel Rates?

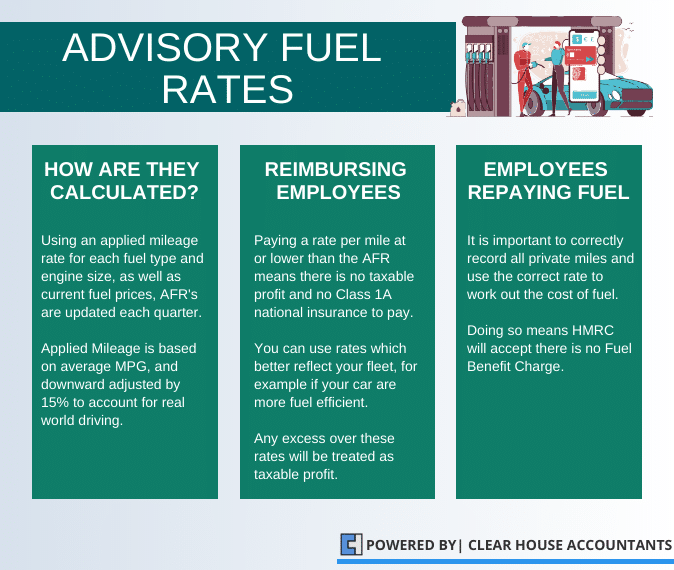

Advisory fuel rates are HMRC’s recommended repayment amounts for reclaiming the fuel-related portion of business mileage. These rates are only applicable to companies that are VAT registered and can only be used by companies that are Standard Rate VAT Registered and not those who are registered for Flat Rate VAT.

We recommend that you speak to a qualified VAT accountant to help you choose the best VAT scheme for your business.

You can use advisory fuel rates to help you calculate:

- The total reclaimable VAT on business mileage when using a personal vehicle

- The amount employers can reimburse their employees for business travel in company vehicles

- The amount that employees have to reimburse their employers for personal travel in company vehicles

What are the Advisory Fuel Rates in 2020?

HMRC has issued new advisory fuel rates that will come into effect from 1st March 2020.

If employers reimburse their employees for travelling in company vehicles for business purposes, then there isn’t any Class 1A National Insurance payable.

Learn more about National Insurance and when it is applicable, and speak to our tax accountants, who are specialists in National Insurance.

HMRC Advisory Fuel Rates 2020 (applicable since 1st March 2020)

| Size of vehicle’s engine (cc) | Diesel | Petrol | LPG | Electric |

| 1400 or less | 12p | 8p | 4p | |

| 1600 or less | 9p | 4p | ||

| 1401-2000 | 14p | 10p | 4p | |

| 1601-2000 | 11p | 4p | ||

| 2000 or more | 13p | 20p | 14p | 4p |

HMRC Advisory Fuel Rates 2020 (applicable from 1st December 2020)

You can use the previous rates for up to 1 month from the date the new rates apply.

| Size of vehicle’s engine (cc) | Diesel | Petrol | LPG | Electric |

| 1400 or less | 10p | 7p | 4p | |

| 1600 or less | 8p | 4p | ||

| 1401-2000 | 11p | 8p | 4p | |

| 1601-2000 | 10p | 4p | ||

| 2000 or more | 12p | 17p | 12p | 4p |

Examples to help you understand how to apply advisory rates in different situations:

Video: What car expenses can you Claim?

Watch the video to learn all about car expenses and how you can claim them.

Reclaiming VAT on a personal car:

George travels 80 miles for a business trip in his personal car. Before starting his journey he fills up £50 worth of gas on his 2500cc engine car.

The fuel rate applicable in George’s situation is 20p as his car’s engine is

2500cc. So £16 out of £50 is attributed to the business trip. This £16 is inclusive of VAT, so the VAT element of the business mileage that he can claim is £ 2.67.

Claiming mileage on a Company Car:

Charles bought fuel for his company car while travelling 450 miles for work. The engine capacity of the car is 2500cc. The advisory rate of this car is 20p per mile, so the employer will reimburse Charles £ 90.

Reimbursing employers for the personal use of a business vehicle:

Emma fueled her company car and took a personal trip of 150 miles. As per the advisory fuel rates, she will have to pay her employer 11p/mile as the company car has a diesel 1650cc engine. So, Emma will have to pay her employer £16.50.

Not all circumstances are straightforward, we advise you to speak to our expert qualified accountants, who can help you with any and all VAT related questions and issues.

Should I hire an Accountant for VAT?

In short, yes, you should hire an accountant. By seeking the expertise of professional accountants, you can mitigate errors that might lead to hefty penalties.

Accountants also help you gather and compile all of your company’s financial records in a succinct and functional manner. They can help you work out your business expenses and may also help you identify valuable tax reliefs which otherwise you may overlook or ignore. Accountants can advise you on applicable laws and regulations, such as advisory fuel rates, that you can avail without having to file dispensation.

Clear House Accountants are highly competitive accountants in London who have experience working with thousands of clients on a variety of business issues.