Car Expenses you can claim when running a Business

Startup owners need to save as much money as they can, either by employing cost-cutting practices, pursuing downsizing or claiming tax reliefs right from the start in order to compete with competitors and survive. Generally, startups look to tax for their accountants to employ smart tax and cost-cutting strategies, but you can do it by yourself as well if you research a bit. We discuss one such strategy in this article claiming car expenses.

One example of such tax breaks is the relief you can claim on expenses incurred on fuel for using vehicles for business purposes. If you are using your automobile for any job-related purpose, then you are allowed to claim the motor expenses cost to run the car as a business expense. What if you are using the vehicle for personal and business reasons? The process can become somewhat tricky and misleading. Therefore, for this very purpose, this article will provide you with the perfect guideline on what vehicle expenses you are allowed to claim. In order to reduce your taxes, there are other business-related expenses other than the vehicle costs that you can claim.

What do you need to know about business expenses?

Business expenses are costs incurred while carrying out daily business activities that are essential for the operation of a business. The rule of thumb is that when claiming business expenses, you need to make sure that the cost was incurred entirely for carrying out a business activity.

Claiming business expenses requires you to separate your personal finances from your business finances. Learn how you can manage to separate your personal and business expenses effectively by speaking to a personal tax accountant.

What type of car expenses are you allowed and not allowed to claim?

The below list shows the type of vehicle-related expenses you can claim:

- Parking

- Fuel

- Insurance

- Repairs and maintenance

- License fees

- Breakdown cover

As far as a ticket for a traffic violation is concerned, you are not allowed to claim that penalty as a business expense.

Also, the cost of fuel incurred by driving the vehicle for non-business purposes, say driving from work to home, can not be claimed as a business expense.

What if you purchase and use a vehicle for business purposes only?

Any cost incurred to purchase a business vehicle can be claimed as a capital allowance.

Related: Capital allowances can get complicated.

If we take the running costs of the vehicle into account, then the good news is that you can claim it as an expense if used for business purposes only. It is advisable to limit your vehicle’s usage for tasks related to business purposes only, as limiting it allows you to calculate and claim the expenses quickly.

Working out the expenses for your vehicle, mainly when used for business and personal reasons, can become confusing; speak to a tax accountant to help you file accurate claims and stay compliant with the tax system.

What if you are using your vehicle for business and personal reasons?

As discussed earlier, you are free to claim tax relief on any expense incurred on your vehicle for fulfilling business needs, personal expenses should not be claimed.

You will need to learn how to work out these expenses on your own if you don’t want to hire a specialist such as an accountant.

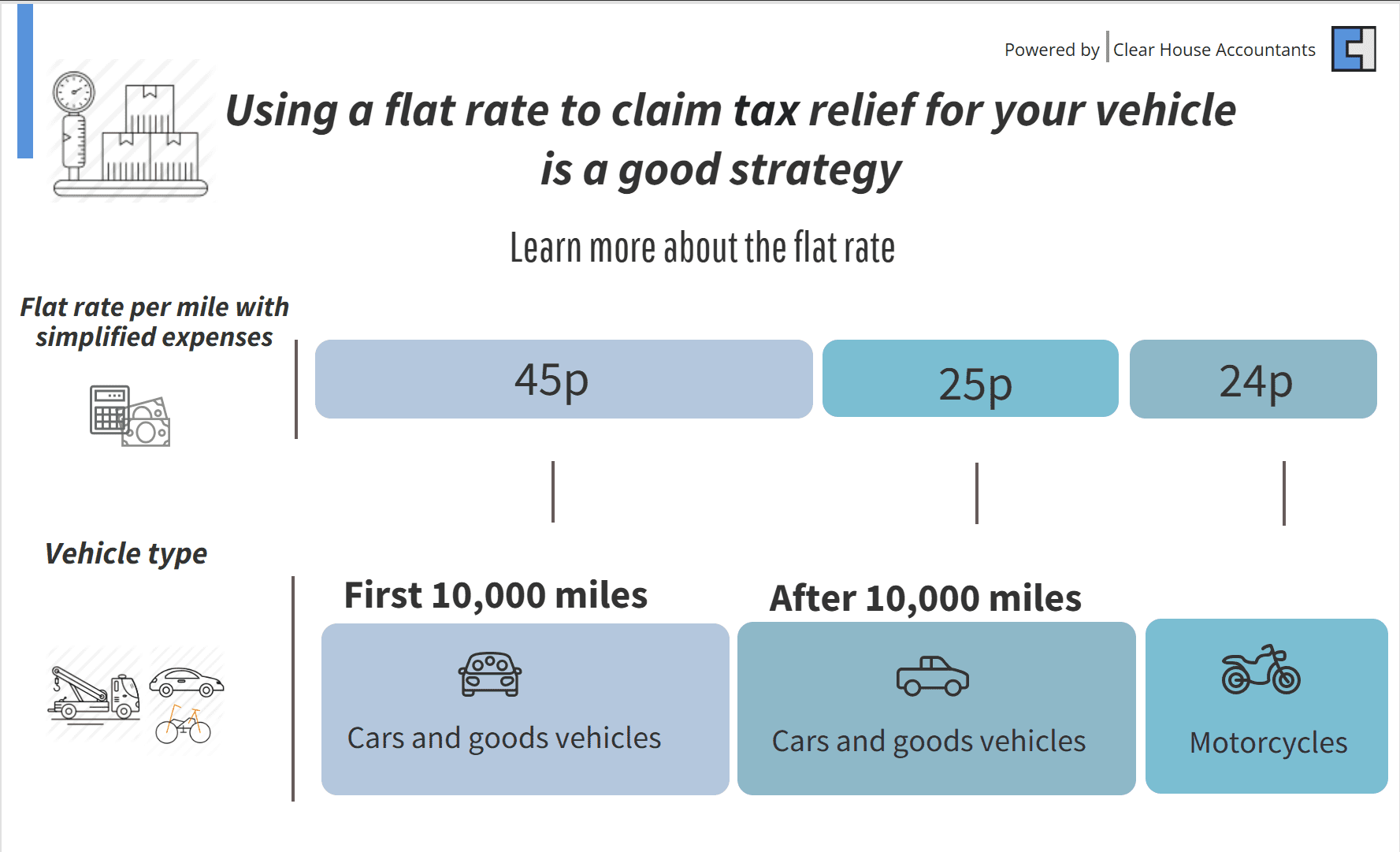

1. Using the Simplified Expenses method

Simplified expense is a method of estimating your business expenses using flat rates instead of employing complicated techniques to work out the actual business costs.

To estimate the expenses you claim, this method employs vehicle costs based on its mileage instead of working out the actual costs of running the vehicle, recommended to use this when the car is not actually owned by the business.

2. By using the Cash-Basis method

This method is ideal for small businesses because they will be required to proclaim the money only when it flows in or out of the business’s treasury. As a result, you won’t have to worry about paying tax on the income you never received at the end of a tax year.

While some business owners successfully estimate and claim their business expenses, most do not. Filing inaccurate claims can always land you in a tax investigation. Therefore, it’s wise to speak to a specialist tax accountant.

Related: HMRC Investigations can get tricky and sometimes be unfair. Learn how and when you can appeal to the tax tribunal.

Clear House Accountants pride themselves on being highly competitive Accountants. Our in-house accountants have been trained to help clients file accurate tax returns, identify potential tax reliefs and provide business expertise and insight to ensure compliance with the government’s tax legislation.