An invoice is a legal archive that you must submit as a transaction for payment. It includes information about the business, customer, product or service bought, sales, prices, taxes, and other requirements. We have curated a list of invoice templates UK including:

- Sole Trader Invoice Template

- Limited Company Invoice Template

- Contractor Invoice Template

- Self-Employed Invoice Template

- Freelance Invoice Template

- Simple Invoice Template

- Blank Invoice Template

It is essential to capture every detail of the contract you will sign. As well as paying your invoices on time, you should also get them written up correctly so that you can consistently produce them if needed.

Standard Invoice Format

- Vendor’s company name, address, and contact details.

- Invoice number and date.

- Customer name and address.

An invoice represents a commercial transaction. It consists of a header that describes the document. The middle section describes the details of the customer and the services/products being purchased, the price for each service/product, and details about the delivery of the services/products.

Invoices should be referenced with unique IDs or numbers. A unique invoice ID or number helps identify the invoice by its unique identifier within the books of accounts. However, the body section of an invoice details the services or products due for payment:

- The service/product sold

- Net amount excluding the VAT

- Gross amount inclusive of VAT

- Details of expenses

At the bottom of the Invoice:

- Details of payment terms

- Vendor’s VAT number

- Vendor’s registration number

Terms of Instalment

A seller should clearly define payment terms to avoid confusion with the important client. The terms of the instalment can be:

- Method of instalment (with cash, by draft, with a money order alongside account subtleties, or by bank move alongside financial balance and sort code)

- Credit period, e.g. payment to be made within 15 or 30 days from the date of invoice

The VAT registration number, company registration number and bank account number should be listed in the business’s name and be included in the invoice. You can automate the process by using electronic software to help you out with the following:

- Generate invoices from clients

- Upload invoices to the system

- Maintain a customer database

- Create recurring invoices for customers

- Upload receipts and bank statements

- Calculate and generate payments

- Maintain accounts

- Generate reports

- Create payment reminders

- And much more

Some contractors and freelancers might prefer to submit their invoices in a specific format. This can be an effective tool for your customers to see what they’re paying for.

Things to Consider While Generating Invoices

Invoice Numbering

There are a few different ways to bill your customer; you can bill by cash, by draft, by cheque along with account details, or by bank transfer.

Credit Duration

Credit duration, e.g. price to be made within 15 or 30 days from the date of consignment.

VAT

The correct cost-introduced tax (VAT) must be charged. Some offerings would possibly fall beneath the exemption class.

Copies

Even if an invoice is cancelled, a copy of it has to be kept.

Payment Terms

The length of time you want to give your clients to pay for the goods or services you provide.

Order Number / Reference

If a patron generates a digital buy order, the seller has to ask for a wide variety of orders and point it out on the invoice. This is up to date in the customer’s system with the consignment important points regularly when the order is delivered. This is very common with large customers.

Bank Details

Bank important points alongside the applicable codes must be noted on the consignment to make the processing of financial institution transfers expedient.

Record-Keeping

Online accounting software like Nomisma Solution is used by businesses. It is possible to enable a system for generating invoices automatically. Businesses will have to record all the invoices if they don’t want to use an online accounting system. Essential items to be noted here are:

Date of Invoice

Date of Payment

Invoice complete together with VAT

Invoice number

Name of the customer

Product description or services

Types of UK Invoice Template

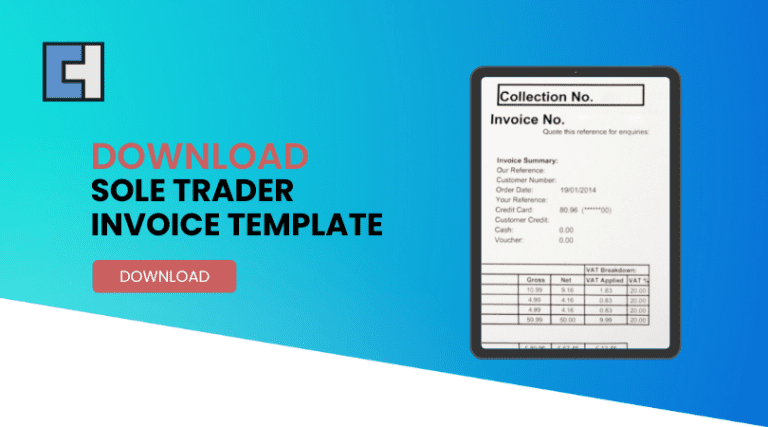

- Sole Trader Invoice Template

It is designed to help you keep track of your business expenses and generate accurate and easy-to-understand invoices.

- Limited Company Invoice Template

This invoice template is perfect for limited companies in the UK. This template includes all the necessary information to create an invoice, including a company name, contact information, a list of products or services provided, and much more.

- Contractor Invoice Template

You can use this template for invoicing your clients for work you have completed or request work from them.

- Self-Employed Invoice Template

If you are self-employed, this template will allow you to keep track of your expenses and invoices and ensure that your invoices are accurate.

- Freelance Invoice Template

A freelance invoice template can be a great way to keep track of your expenses while working as a freelancer. This template includes space for your name, the date, the amount paid, and the client’s name.

- Simple Invoice Template

A simple invoice template can help you keep track of the costs associated with your business. This template includes information such as the customer’s name, address, and purchase amount.

- Blank Invoice Template

A blank invoice template is a template that is used to create invoices. This template is usually in the form of a Microsoft Word document or could be in any format. It is used to list the items that will be included in the invoice.

Additional Resources

Final thoughts:

A good invoice template can make you a better business. Invoicing is an integral part of the business process. It would be best to have the invoice ready as it is the first step toward receiving payment. This will ensure that you are paid promptly.

Make sure that you use the correct invoice format. If you want to get paid, you need to ensure that the invoice you send is correct. The invoice must include all the details of the transaction which has become easier with online accounting and invoicing software.