How to hire Employees?

It’s hard to find the right talent for businesses and every business owner has once wondered ‘how do I hire employees?’. You need someone with the skillset and experience to help you grow, but it’s difficult to find someone who is a perfect fit and available at the right time. Businesses regardless of industry are constantly changing, so you need to stay updated with the latest trends and become agile to hunt real talent. And because finding the right person can be such a challenge, you may need a partner who understands your business industry and culture inside and out. If you are looking for employees in the technology sector, you can benefit from hiring one of the top IT recruitment firms having the expertise and resources you need to find the best talent for your business. The same goes if you are looking for any other industry.

Our payroll expert accountants have researched and curated an in-depth guide on how you can hire employees for your company. Here is a list of things you need to work on:

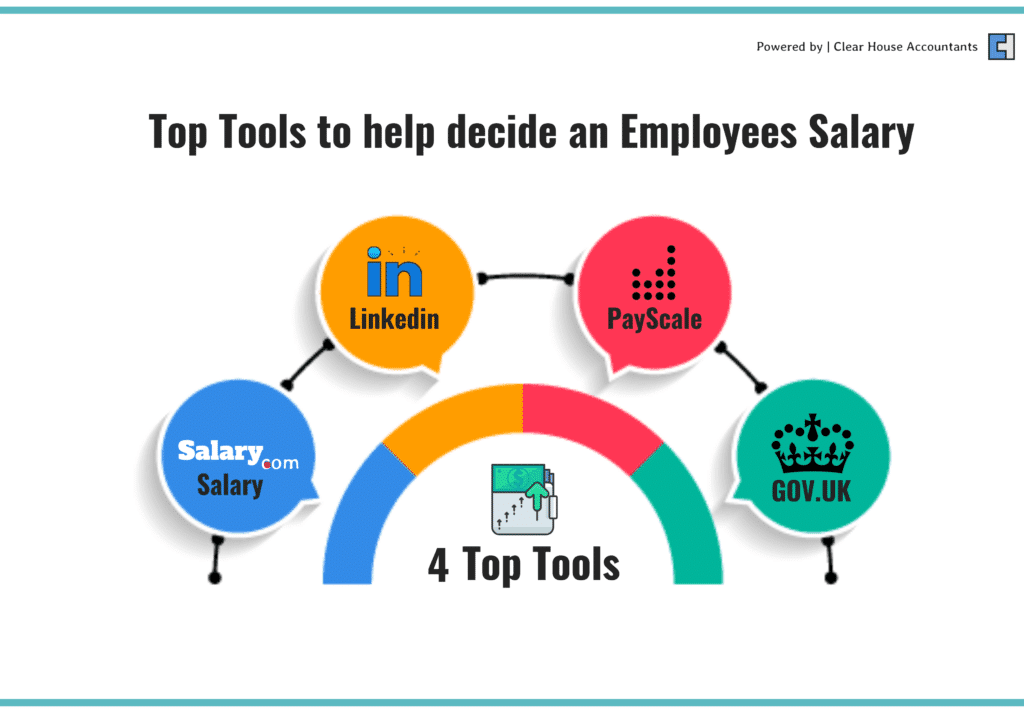

Decide how much you want to pay

You have to decide the amount of salary you are ready to offer to your potential or existing employees. Ensure that the amount must not fall below the National Minimum Wage.

What do you need to know about the National Minimum Wage in the UK?

In the UK, your age and the status of your job will determine your hourly minimum wage

The following conditions must be satisfied to get the National Minimum Wage:

- You should be at least school leaving age (school leaving age depends on where you live).

- You should be at least 25 years old to get the National Living Wage- the minimum wage is still applicable for employees aged 24 and under.

Speak to a competitive accountant in London to learn more about apprentices, minimum wage rules and how to make sure you are offering a salary which the business’s cash flow can sustain. You can also view our cash flow forecasting guide to learn more about it.

Current rates for the National Minimum Wage and National Living Age in the UK, if you want to are going to hire an employee and do not know the numbers:

| Year | Under 18 | 18-20 | 21-24 | 25 & above | Apprentice |

| April 2019-2020 | £4.35 | £6.15 | £7.70 | £8.21 | £3.90 |

| April 2020-2021 | £4.55 | £6.45 | £8.20 | £8.72 | £4.15 |

| April 2021 | £4.62 | £6.56 | £8.36 | £8.91 | £4.30 |

Check the employee’s legal status

You have to personally inspect whether the person is legally allowed to work in the UK. It’s advisable to perform all the possible employment checks early on. You can:

- Inspect the application’s original documents such as visa, right to work documents, original passport etc.

- Inspect the application’s eligibility to work online (f they have provided you with their share code)

Note: Bear in mind that any illegal worker you employ in your firm can cost you a civil penalty, fines and even the closure of your business

Here is a list of things to keep in mind when inspecting the applicant’s right-to-work documents:

- Examine the original documents carefully

- Check the validity of the documents

- Make sure that you keep copies of the documents and note down the date on which you performed the employment checks.

What to inspect?

We advise you to perform the following checks to check the working status of the applicants:

- Investigate that the documents provided are original, genuine and have not been subject to any changes. Also, ensure that the documents belong to the person who has submitted them to you.

- Check the expiry date of the applicant’s right to work and what kind of work visa they hold?

- Ensure that all of the photos provided are the same across all documents.

- Make sure that the photo must resemble the person providing the documents.

- Check that the DOB is the same across all documents.

- Check whether the applicant is allowed to perform the types of duties you are offering and if their visa allows you to do so.

- For students, demand and inspect the evidence of their studies along with vacation times and how many hours are they allowed to work as per their visa rules.

- If you see that the documents provided have 2 different names, then check whether the applicant has supporting documents like a marriage certificate or divorce decree as proof.

To learn more about what documents you can accept and how to perform the right to work checks, we advise you to speak to an employment lawyer or HR consultant.

Verify if a DBS check is required

You have to check if you need to perform a DBS check for your employee. This check might be mandatory in certain job roles and industries, for instance, security jobs.

Disclosure and Barring Service (DBS) are checks you can perform to see someone’s criminal records. There are four types of DBS checks you can carry out:

- A Basic DBS Check: Helps reveal information about unspent convictions and conditional cautions.

- A Standard DBS Check: Helps gather information about spent and unspent convictions both, along with cautions, reprimands and final warnings

- An Enhanced DBS check: Reveals the same amount of information as a Standard check along with relevant information to your role held by the police

- An Enhanced DBS check with barred lists: Reveals the same amount of information as an Enhanced check along with the confirmation that whether the applicant is on the barred list of performing the role or not.

These checks can be important as well as absolutely necessary when hiring someone for a sensitive role, such as someone handling cash, taking care of children, or performing security roles.

The list of jobs that require DBS checks:

There is a long list of jobs that require DBS checks in the UK. Mentioned below are some of the roles you should be looking out for:

- Teachers

- Social workers

- Solicitors

- Accountants

- Medical professionals

- Veterinary surgeons

- Barristers

Work out your insurance

You will have to get employment insurance if you hire and manage staff. You are liable to apply for employer liability insurance soon after becoming an employer.

Your insurance policy should come from an authorized insurer and should cover up to at least £5 million. This insurance helps you pay compensation if your employee gets injured or ill while performing duties for you.

Note: If you do not get yourself properly insured, you might face up to £2500 as penalties every day for which you do not have insurance. Also, you may be fined up to £1000 if you refuse to show your Employment Liability certificate to the inspectors when requested.

You must ensure that your insurer is authorized. You can check this by examining the Financial Conduct Authority register or by contacting the Financial Conduct Authority.

Video: Step-by-step guide on Running Payroll

Here’s a complete guide to setting up your payroll function so you can report PAYE information to HMRC in real time. Watch this video to understand how to set up payroll.

Send a statement of employment to your employee

You have to send relevant details about the job in writing, including its terms and conditions, to your employee. As an employer, you have to submit a written statement of employment to any employee you hire for more than one month.

Inform HMRC

You have to inform HMRC by registering as an employer. You are allowed to notify HMRC at least four weeks before you pay out salaries to your employees. We have curated an in-depth guide to help you with payroll compliance.

As an employer, you will be liable to inform HMRC whenever you don’t pay your employee(s) in a tax month.

There is a set of things you need to do on or before your employees’ payday:

- You need to record your employees’ pay- which includes their wages and any other pay (for instance, commissions).

- You will have to estimate tax deductions from their pay- like income tax and National Insurance NI.

- After estimating deductions, calculate your National Insurance Contributions that you’ll need to pay on their salaries above £166 per week.

- You will have to produce payslips for each employee.

- In the end, you will have to report your employees’ pay and deductions to HMRC in a Full Payment Submission (FPS).

If you find this process complicated you can contact us to fully outsource your payroll process to us.

- A Comprehensive Guide to Payroll Compliance

- For further details on managing your tax obligations, including completing self-assessment forms, see our comprehensive Guide to HMRC Self-Assessment Forms.

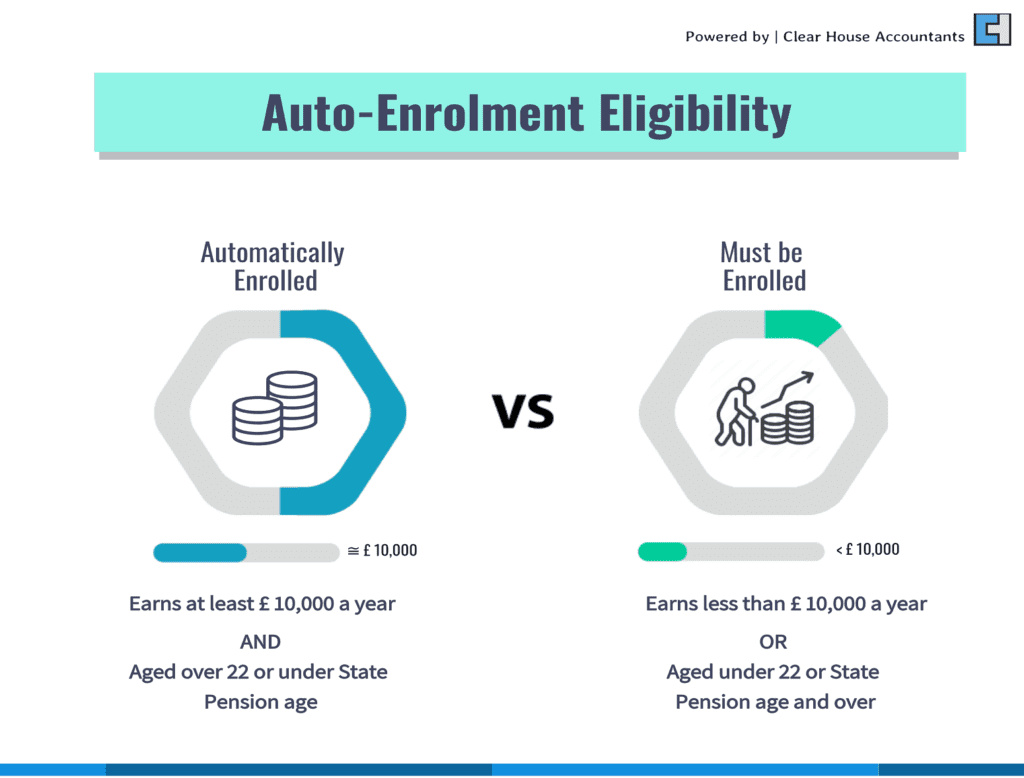

Register your employees under a pension scheme

You might have to enrol your staff under a workplace pension scheme automatically, so it’s wise to check early on if you need to register them or not. You can check on the pension regulators’ website.

You will have to enrol your employee under a workplace scheme if:

- Your employee is not enrolled under one

- Your employee is aged between 22 and the state pension age

- Your employee earns more than £10,000 per annum

- Your employee usually works in the UK

There are two types of pension: State pension and Private pension

State pension: The state pension is a regular payment made by the UK government once the individual reaches his state pension age.

Private pension: The private pension is a planned contribution made by individuals every month out of their earnings to save money and make retirement financially viable.

Hiring the right employees is crucial for your business, as your company’s progress highly depends upon the team you choose. Our research report confirms that good teams are the secret sauce to a startup’s success. We advise you to speak to a qualified accountant in our accounting firm to help you design and process the most effective way to hire employees and manage them.

Clear House Accountants are highly specialised accountants with years of experience helping businesses set up and grow effectively. We have a team of specialists who can help you on various matters at different stages of your business lifecycle.

Additional Resources