VAT on Education

Businesses usually hire specialist Accountants for their VAT matters as VAT can get complicated and requires to be treated in different ways depending on the industry and the specific regulations around it. In this guide, our team of London Accountants did an amazing job in helping me research and find answers to all the various questions you might have in terms of, VAT in the education industry.

For instance, are:

- Educational institutions vat exempt?

- Is training VAT-exempt?

- What are the VAT treatments in the UK’s education industry?

VAT in the Education Industry

What is included in VAT for Education?

- Educational conferences, seminars and symposia

- Lectures

- Sporting and recreational courses

- Distance teaching and related materials

Registration fees may also be included for the above.

It is necessary to determine whether it is a single supply, or if a variety of elements are being supplied, then you need to check if it’s multiple supplies to determine how to apply VAT on education.

How does the single and multiple supply work

Single supply: The VAT rate of the predominant part of the supply will be applicable to the entire supply.

Multiple supplies: The VAT rate will be determined after the assessment of each part of the supply.

VAT determined by Business or Non-business Activity

For VAT purposes, business is a very widely drawn area

- When looking at education supplies, it is normally the activity of making educational supplies to other individuals for consideration

- Where consideration is charged for educational provision then is it most likely to be business income.

- Activities resulting in losses can be considered businesses for VAT purposes as well

- Supplies may fall within zero-rating, reduced-rating or exempt supplies if the supplies are UK-business supplies.

- Supply may fall outside the scope of VAT for the purposes of UK VAT if the place of supply is not the UK.

- The business supplies will be considered as standard-rated supplies of education if the supply does not fall under any of the categories mentioned above.

Non-business income usually includes income or funding that has been received through government grants, voluntary donations and activities provided for no consideration.

If the supplies are being provided at or below cost, then the supplies that are associated with free educational provision can be considered as non-business.

It is advisable to speak to a competitive VAT Accountant or finding a competitive small business Accountant if you do not have one to help you identify business and non-business income in your education business.

Types of Rates That Can Apply to An Education Business

Zero-Rated

- Books that include school workbooks with blank spaces to answer, journals, booklets, and printed music provided with charges can be zero-rated. E-books can not be considered as zero-rated.

- Children’s clothing is zero-rated. For instance, school uniforms. Zero-rating may be applicable on maximum sizes.

- The business has an option on whether to treat the supply as zero-rated or exempt if it is associated with the supply of exempt education.

- If it is a single supply of printed matter, then the distance learning courses may occasionally be considered as zero-rated. However, if it is a multiple supply of printed matter and education services, then the supply should be distributed between education and zero-rated printed matter.

Reduced-Rate

- Welfare information and advice are reduced if it is provided by charities or private welfare institutions under state regulations.

- The exemption gets priority if the supply provided by the eligible body falls under exempt education.

- The advice provided must be directed to the welfare of aged, sick, distressed or disabled persons physically or mentally or to the protection or care of children or young persons.

VAT Exemption For Education Providers

Exemptions are of two types:

- The one that is not based on the learner’s age.

- The one that is based on the learner’s age.

- All education and vocational training is exempt from VAT on education if it is being provided by an eligible body

- Private tuition of a subject provided by an individual teacher, who is independent of the employer, in a school or university is exempt.

- Examinations services supplied by an eligible body or a teacher are exempt.

- Given that the consideration is primarily funded according to government acts (for instance, apprenticeships act or employment training act), educational or vocational training, along with any necessary goods supplied by the same person, is exempt.

- Educational or vocational training supplied with all relevant goods where it is provided by the same person and is paid by the secretary of state will be exempt if the recipient is:

- Under the age of 19.

- Is 19 or over but began their education before the age of 19.

- Started education at the age between 19-24 and is subject to learning difficulty assessment.

- Eligible body’s provision of goods and services closely associated with education will be exempt if:

- The students receiving an education are directly using the goods and services provided.

- The same eligible body is making goods and services or the goods and services are made from one eligible body to another body, who is making the supply of education.

If you are confused and unsure about the type of education and VAT Accounting and do not know where to start from, then speaking to a VAT Accountant might be a good first step.

VAT and Training Courses

VAT on training courses differs. Many people ask if training is exempt from VAT. Or do you pay VAT on training courses? Not all types of training courses are VAT exempted. For vocational training, where there is in-person interaction between the trainer and trainee, and the purpose of training is to induce skills in a person that will benefit them in future is vatable training. Online training courses come under digital services, where virtual training is done online, and 20% VAT rate applies on such training courses.

What are Eligible Bodies?

Eligible bodies would be as follows:

- Would be a school according to the UK Education Act, a school can be considered either of the following:

- Registered independent

- Community, foundation or voluntary school

- Maintained school

- Special school

- UK university (does not include subsidiary companies of universities)

- Other appointed institutions under the UK’s Further and Higher Education Acts

- Public bodies include:

- Government departments

- Local authorities

- A non-profit body acting under an enactment or instrument for public purposes, performing government department duties or local authority’s functions.

- A body investing profits from the supply of education to enhance and improve those supplies, given that they cannot and do not manage or distribute any of the profits.

- A body that provides teachings of English as a foreign language

Private Tuition and VAT

Private tuition exemption is usually the most misunderstood part of VAT education exemption. Under the following conditions, there is no VAT on teaching privately.

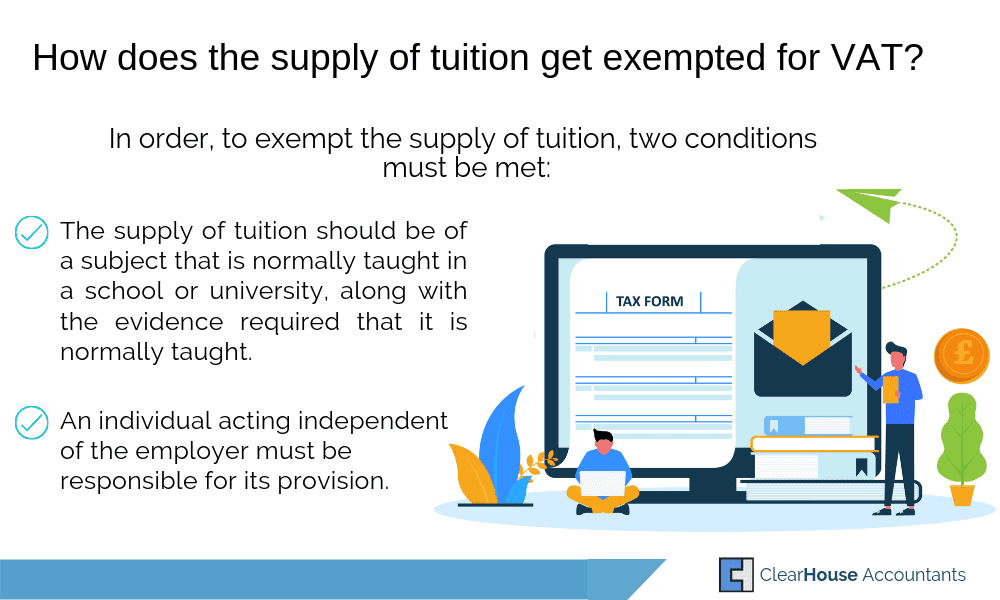

In order to exempt the supply of tuition, two conditions must be met:

- The supply of tuition should be of a subject that is normally taught in a school or university, along with the evidence required that it is normally taught.

- Individuals acting independently of the employer must be responsible for its provision.

Here are examples of courses that do not qualify as normally taught in a school or university

- Belly dancing

- Yoga

- Pilates

The following qualify as normally taught in schools:

- Golf

- Tennis

You also need to make sure about these points:

-It should be supplied by an individual teacher who is independent of the employer.

-Sole traders and partnerships qualify if the partner is providing the tuition.

-Limited companies can not qualify, as the tutor is dependent on an employer.

What are Examination Services?

These services are used to ensure the maintenance of educational and training standards and can include conducting and marking exams, the setting of education or training standards, the making of assessments and other services. This all comes under the educational services that are VAT-exempt.

Closely Related Goods and Services

If the education is being provided by an individual who has non-business income, for instance, income through grants, then any closely related goods and services provided with that education may be treated as non-business.

In order to be non-business, closely related goods and services must be provided at cost or below, that is, must not be making any profits

Any goods or services that are closely associated with the supply of education are exempt if the supply of education by an eligible body is exempt. For those goods or services, there is no requirement for them to be non-profit making:

The following can be considered as closely related goods or services under VAT on educational material:

- Sports equipment (excluding clothing)

- Maths equipment

- Student accommodation

- Student transport

- Student catering

- School trips

- Field trips

You should also know that:

- Normal VAT treatment will be applied to goods or services that are not closely related to the supply of education.

- Closely related goods do not include laptops.

- Normal VAT rules for food and catering are applicable to the meals that are provided to staff.

According to HMRC, services can be considered as closely related goods and services if:

- The education is provided by way of business

- The students must lead the activity, which should be necessary for their education

- The purpose of the activities does not revolve around generating extra income that comes in direct competition with commercial businesses. This implies that:

- Advertising should not be adopted as a means to offer services to the general public.

- The cost of providing the services to the general public plainly goes beyond any income that is generated.

Supplies of Staff

The supply of teaching staff or faculty from one eligible body to another is exempt.

The standard rating is generally applicable to the supply of staff.

How to Recover VAT on Education?

If an education provider is making any taxable supplies, either zero-rated, reduced-rated, or standard-rated, they are eligible to register for VAT.

The education providers must register for VAT if the taxable supplies they are making go beyond the VAT threshold in a similar manner as any other business

VAT can be recovered by the provider to the limit that it is incurred on costs directly related to the taxable supplies if the provider is VAT-registered. However, evidence will be required, and VAT must be properly charged at the true rate. Click here to learn more about VAT.

A partial exemption might be needed to calculate the amount of VAT related to non-business or exempt supplies and the residual VAT that links to taxable and non-taxable supplies that is eligible to be recovered only if the business is partially exempt or possesses non-business supplies along with taxable supplies.

Speak to an Accounting firm, or if you do not have one, try looking for the term accountant online to help you claim the correct VAT amounts effectively without making any huge errors.

Clear House Accountants are specialist Accountants in London, our trained in-house VAT Accountants make sure that smart and effective solutions for VAT are implemented for our clients while ensuring accuracy and savings. Speak to us to learn more.

Frequently Asked Questions